Abstract: The level of the collaboration of third-party logistics users and logistic service providers are elaborated in Turkey. The synergy which is expected to come out after this cooperation seems to be lacking. Therefore the industry of Turkey is operating by carrying the opportunity cost of this synergy. The purpose of this paper is defining the reasons of the necessity of third-party logistics (3PL) using and exploring the reasons of being reluctant to this kind of collaborations. An empirical study is conducted in industrial organizations in Turkey. The research is designed according to the structure of the Turkish companies and the main issues of the logistics. Semi-structured interview are used to collect information and learn the opinions of the managers of the companies. The responses from 7 logistic service provider companies and 10 from some other randomly selected companies were evaluated at this exploratory research, 17 valid responses are analyzed. According to findings of this study, the expected synergy does not seem to be able to appear before the removement of some prejudices and embracing the modern and effective methods. On the other hand, size of the companies is strictly correlated with outsourcing and it is the reason of inadequate demand in Turkey.

Keywords: third-party logistics,logistic service providers,synergy,Turkey.

Resumo: O nível de colaboração de usuários terceirizados de logísticos e provedores de serviços de logística na Turquia é estudado. A sinergia que se espera nesta cooperação parece estar a faltar. Portanto, a indústria da Turquia está operando levando o custo de oportunidade dessa sinergia. O objetivo deste artigo é definir as razões da necessidade da terceirização em logística (3PL) usando e explorando as razões de relutância em relação a esse tipo de colaboração. Um estudo empírico é conduzido em organizações industriais na Turquia. A pesquisa é projetada de acordo com a estrutura das empresas turcas e as principais questões da logística. A entrevista semi-estruturada é utilizada para coletar informações e conhecer as opiniões dos gestores das empresas. As respostas de 7 empresas prestadoras de serviços logísticos e 10 de algumas outras empresas selecionadas aleatoriamente foram avaliadas nesta pesquisa exploratória, sendo analisadas 17 respostas válidas. De acordo com os resultados deste estudo, a sinergia esperada não parece ser capaz de aparecer antes da remoção de alguns preconceitos e da implementação de métodos modernos e eficazes. Por outro lado, o tamanho das empresas é estritamente correlacionado com a terceirização e é a razão da demanda inadequada na Turquia.

Palavras-chave: logísticos a terceiros, prestadores de serviços logísticos, sinergia, Turquia.

Articles

DEMAND OF OUTSOURCING IN TURKEY: AN EMPIRICAL STUDY

DEMANDA DE OUTSOURCING NA TURQUIA: UM ESTUDO EMPIRICO

Received: 05 October 2017

Accepted: 06 November 2017

The efficiency of the companies mostly depends on the efficiency of logistic operations. The companies prefer to focus on their core competencies. With this purpose they cooperate with the logistic companies. The logistics companies can increase their productivity by using scale economies. The growth, which can enable economies of scale can be created by using ?outsourcing?. If outsourcing becomes widespread, the logistic companies will be able to operate more efficiently by using economies of scale.

Economies of scale can decrease the costs. Especially logistics companies can use economies of scale to reduce the costs, because the expensive vehicles will be used for longer periods without interruption. It is possible to avoid unitilized capacity, if the company is growing.

The contractual strategic alliances can increase the power of the companies. The logistics companies work effectively on any part of the supply chain. Consequently, they can connect the company to another one unwillingly or deliberately. The flexible mobility of logistics companies on the supply chain increases their strategic management ability. For example, they can increase the connection of certain companies if they believe that it will be useful for them. These kind of advantages can shape the markets.

Mobility, which is one of the main aspects of economy and the main assumption of perfectly competitive market, cannot be thought without logistic operations. Mobility is also the most important resource of power. Cement and steel sector can be shown as an example. These products are too heavy to benefit from mobility. Any attempts will result in an increase on the costs. That is why they are regional companies and such sectors cannot globalize.

The regional companies can also use outsourcing. Especially the steel and cement industries have such a requirement. Because huge capitals are necessary for such operations, but the stability of the industry is not always possible. Such fluctations mean a great loss for these companies if they have their own fleet. Vessels, trucks or planes will not be used during recession periods, but they will still provide some extra costs to the company. But the logistics companies can manage such costs. They can allocate their vehicles to their clients. They may operate with lower profit margins during recessions, but with a clever planning, they do not operate with loss.

The value of the logistic sector is significant and the weight of this sector among the others is increasing. The logistics sector in Australia is worth approximately a $60 billion or approximately 9 percent of Australia?s GDP ( Rahman, 2011). This figure is similar to other developed countries like Japan, China and USA. The manufacturing companies noticed that profit is the remaning part of earnings after subtracting the costs. The logistics companies can reduce the costs and they can follow some operations better than the other companies. This situation provides agility to the companies. This agility is related to the operations and strategic management. The companies can create moe time for their operations about their core competence if they do not spend time with activities such as transportations. They can also use more strategies, if the logistics companies have a wide network.

The supply chain management is also important. Sometimes the companies and the suppliers cannot get along and the logistics companies act as a bridge between them. This capability of the logistics companies can provide advantage to the companies, if these suppliers can provide the best prices.

The improvement of the supply chains means more efficient operations in any country and a better GDP. Because logistics companies can operate mroe efficiently and the resources of that country will be protected. Besides a new industry can decrease the unemployment. It is also withnessed in Turkey. The growing logistics sector provided many new jobs to the students. With this impact, new departments on logistics are opened in Turkey at the last decade.

The logistic sector of Turkey also needs improvement. The family companies still needs to be more institutionalized. The strategic alliances with the logistics companies can be ignored. Sometimes the logistics companies tend to neglect such possibilities.

The weight of logistic sector is not clearly known in Turkey. The traditional management techniques of Turkey do not include outsourcing, that is why Turkish companies can avoid outsourcing. The habits cannot change easily. The property is the main reason of embracing traditional management. Some owners still thinks that owning the vehicles is an advantage and they can become more valuable in time. But conversely they can just lose value and create costs in time.

The improvement of logistic sector is highly correlated with 3PL requirements. Anyway there is always such a need. If this need is realized there will be a tendecy to embrace this kind of applications.

The existing logistic companies does not seem to be focusing on efficiency. Quality management and constraint management are rarely concerned by the logistic companies. The logistic operations are focused on the costs more than efficiency. Even the employees are chosen by evaluating the wage demand, instead of the talents.

The last decades are very dramatic for logistic information systems with the help of ever-growing nature of the computers and data processing. Logistic information systems (LIS) are a kind of management information systems, which aim to give management the right information at the right time. Logistic information systems, manages these informations in three sub-systems which are production, materials management and maintenance ( Segura, 1985). Therefore, the logistics operations are becoming more professional. The logistics companies can focus on their operations and with the help of LIS, they can provide a fast information flow. The fast feedbacks can support the operations and prevent backwork. A backwork is always a burden for the company, and LIS can manage the probabilityof backwork.

In other words, the goal of LIS is to manage the total flows of information and distribution from suppliers, until it ends up at the end customers ( Houlihan, 1987; Cooper et al., 1997; Simchi-Levi et al., 2000; Tam et al., 2002: 28). The logistics companies can use a LIS with many different purposes. For example, it can be used for a market research. That is why these systems are necessary for a logistics company, if they want to be recruited by huge companies more often.

The demand of ?outsourcing? will become a habbit after a while. Consequently, the first step must be attracting the customers with a professional system. The companies will benefit from the system of the logistics companies, instead of constructing a new one as this will be more costy for them. Besides getting experienced on such a new system also requires time.

There are a lot of challenges for firms to operate effectively, firms must endure these challanges to be able to ensure their continuity. The LIS are necessary at the process of outsourcing especially. But professional information technology services (ITS) can be provided by professional companies, and these companies experience their own challenges.

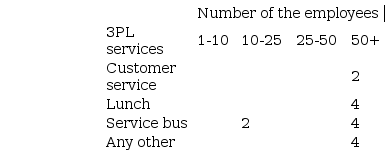

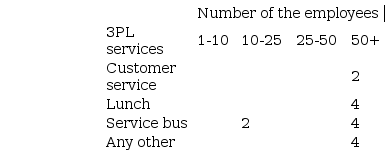

Financial operations, funding, market structure, labor quality, lack of successful managers, ambigous legislation structures and lack of scale economies are the main challenges of these companies. To be able to survive, outsourcing is also necessary for ITS firms. Outsourcing seems to be taking place at every part of the chain. ITS firms are necessary for outsourcing, and outsourcing is necessary for ITS firms. We can have a look at ITS firms of Taiwan to understand the situation better. If a company has an outsourcing problem, then it can move to another country to get rid of this problem. It also happens in Taiwan and the companies may move to China. At Table 1, Tseng (2009) shown the main outsourcing challenges of Taiwanese ITS firms.

Outsourcing challenges for Taiwan

Tseng, Sheng-Ying. (2009). Strategic positioning of Taiwan in the outsourcing market: Evidence from information technology services and electronic manufacturing outsourcing to China, Florida International University.

LIS can be used as a whole, without dividing into three sub-systems. According to Swanson (1988), the aim of dividing operations in three segments is to manage them effectively. Hence, a production manager should maintain an efficient production system, while a materials manager should minimize the costs of the materials while maintaining the overall quality of the product. And last but not least, maintenance managers should minimize maintenance costs and equipment failures.

3PL research is empirical-descriptive in nature and that it generally lacks a theoretical foundation ( Selviaridis and Spring, 2007). Logistics management to work with maximum effectiveness, the entire management group of an organization must understand the nature of interrelationships between the functional areas of the organization, as well as the interrelationships between their organization and customer requirements, and their organization and suppliers, and third-party participants in the logistics channel ( Gilmour, Driva and Hunt, 1995).

Outsourcing is not spreaded in Turkey. There is still a high percentage of firms which have not outsourced their logistics activities in Turkey. Turkish businessmen are not aware of the benefits of outsourcing logistics activities ( Akta? and Ulengin, 2005). On the other hand, 3PL user companies have some different kinds of problems. A pilot project which is conducted at an automotive company to redesign its logistic operations, has shown that the 3PL providers also have some lacking abilities. 3PL providers in Turkey must improve their capabilities and act proactively in providing value-adding services as the companies are becoming more demanding in their expectations in building strategic relationships ( Göl and Çatay, 2007).

A variety of factors that may impact on the future use of 3PL services can be identified, namely: the extent of use of 3PL service providers, the effect of the usage of 3PL providers and future plans concerning the use of 3PL providers. It is observed that a great many users are reducing in-house operations and using 3PL service providers instead. Many users are contracted to multiple contractors ( Rahman, 2011). Firms, usually manufacturers or retailers, have tended to outsource all or part of their logistics activities previously performed in-house to one or more specialty firms or logistic service providers in order to concentrate on their core competences ( Liu et al, 2010). The concept of core competence is not embraced enough in Turkey and the companies prefer to enter various markets to get a share instead of focusing on a core competence.

The logistic operations of the companies will be more efficient with the use of technology, just like all the other operations. But sometimes the logistic operations are not accepted as primary objectives and use of thechnology at these operations are seen unnecessary. On the other hand, these operations are the priority of the logistic service provider companies and logistic service provider companies are expected to be the close follower of the technology. Therefore outsourcing can increase the efficiency of the companies together with the logistic service provider companies.

The technological improvements developed by firms (and their partners) produce two effects: a growth of intangible value (through creativity) and an increase in competitors? vulnerability because of the threat of the spread of technological standards ( Utterback, 1994). At the same time, technological improvements can provide competititve advantage and reduce the costs at the long-term.

A growing number of participants in transport operations has led to increasingly complex distribution setups with augmented needs of information flow, especially electronic messages between participants in distribution setups. This trend calls for new kinds of transportation management systems that move data and information more effectively between partners, increase freight visibility, monitor involved activities in a better way, and increase interaction with infrastructure information to enhance dynamic routing and methods to increase transportation security ( Stefansson and Lumsden, 2009). Security, especially transportation security is important to keep the operations continous and prevent interruptions.

The development of technological effort constitutes a crucial strategic orientation for logistics service providers. The functional status of the provider is evolving from that of an executing subcontractor to that of a joint managing partner in the organization and management of flows. The logistics service provider is gradually taking on the role of key interface in the functioning of information systems, for one central reason: it is best positioned to manage contingencies in the industrial and distributor markets. It ?profits? from the uncertainties of its customers. Its development logic is thus opportunistic, necessarily founded on logistical information and mastery of new technologies ( Sauvage, 2003).

The main drivers impacting on transport operations are delays, delivery constraints, lack of coordination, and variable demand/poor information. The consequence of these is to reduce the efficiency of transport operations ( S-Rodrigues, Potter and Naim, 2010). These constraints can be removed by freight villages. The high costs associated with land acquisition and freight village constructions as well as with the operations of storage and distribution systems, impose the systematic investigation of all related aspects that include site location selection, site-level layout planning and warehouse design aspects ( Ballis and Mavrotas, 2007). Together with these events, freight villages increase efficiency and reduce the costs.

The first freight villages were created in France early 60' and later on appeared also in Italy and Germany, Netherlands, Belgium and the United Kingdom [Kapros et. al. (2005)]. In international bibliography, the term ?nodal centre? or ?freight nodal terminal? is encountered with various names: ?Freight Villages? (United Kingdom), ?Platformes Multimodales/Logistiques? (France), ?Interporti? (Italy), ?Gueterverkehrszentren? (Germany) (Tsamboulas and Dimitropoulos, 1999).

The countries which does not use freight villages face various problems. For example China, for the outsourced manufacturers in China to provide logistics services to local and foreign customers, they are required to restructure their organizations and adjust their operational strategies. Furthermore, due to the lack of adequate logistics infrastructure in China, the level of logistics functions performed by local manufacturers-cum-suppliers is generally below world standards. Even though the Chinese government has gradually loosened its regulations on logistics development policy, there is still a significant gap between the policy and actual needs. If manufacturers are left with their traditional production and logistics methods and their organizational structures remain unchanged, Chinese companies and organizations are sure to encounter problems with low efficiency, and inefficient logistics management ( Rahman and Wu, 2011). Turkey is another country without the freight villages and the 3PL logistics has to be improved. The only freight village is located in Samsun and still not completed. Some other 10 freight villages are being planned.

Service providers conveyed that the meaning customers attribute to the brand is the decisive factor in reducing perceived risk and uncertanity, increasing trust and loyalty, and building an attractive and compelling brand ( Marquardt, Golicic and Davis, 2011). Brand loyalty provides more stable demand at the same time. Not only production, but also the logistic services can be done more regularly and systematically when the demand is stable.

Brands play a central role in marketing and have attracted the attention of academics and practitioners over many years ( Brodie, Whittome and Brush 2009). Brand equity is one of the most important signals of the successful operations ( Erdem, Swait and Valenzuela, 2006). The customer loyalty is highly correlated with the brands.

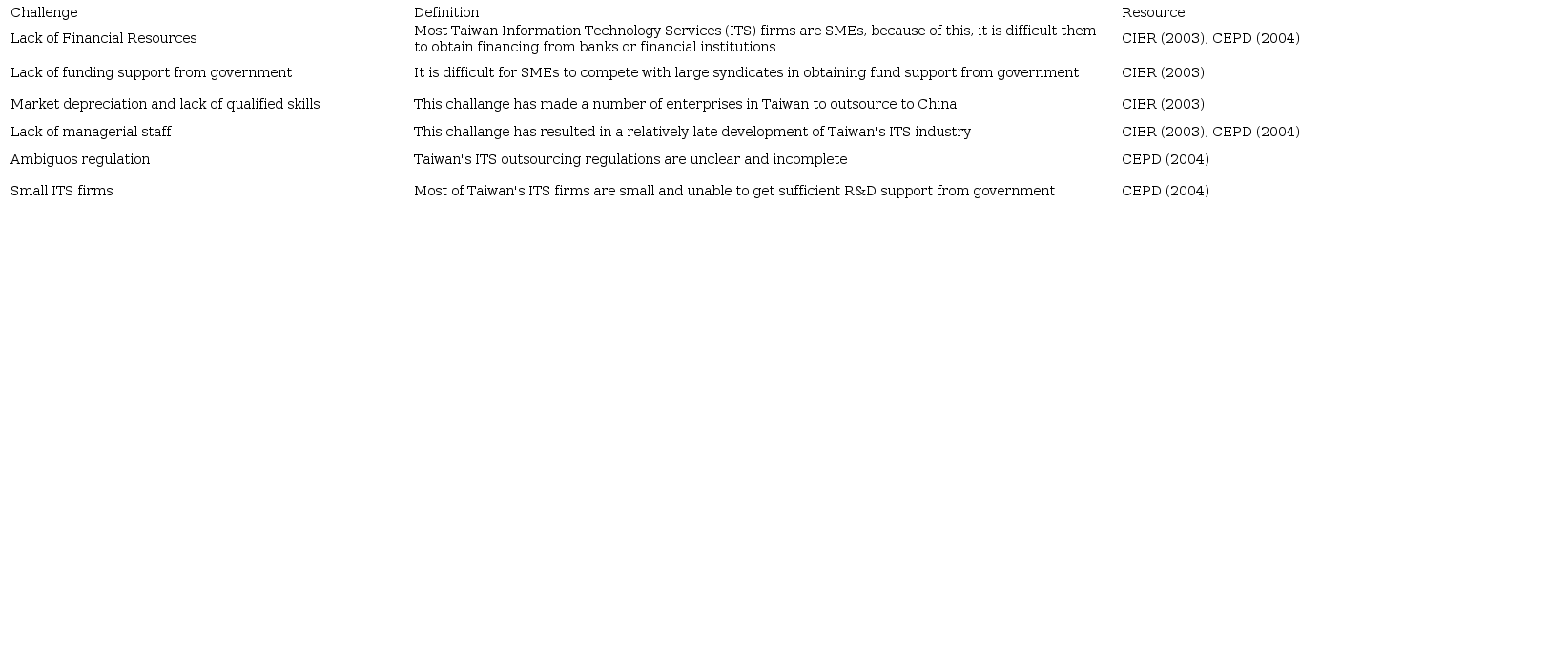

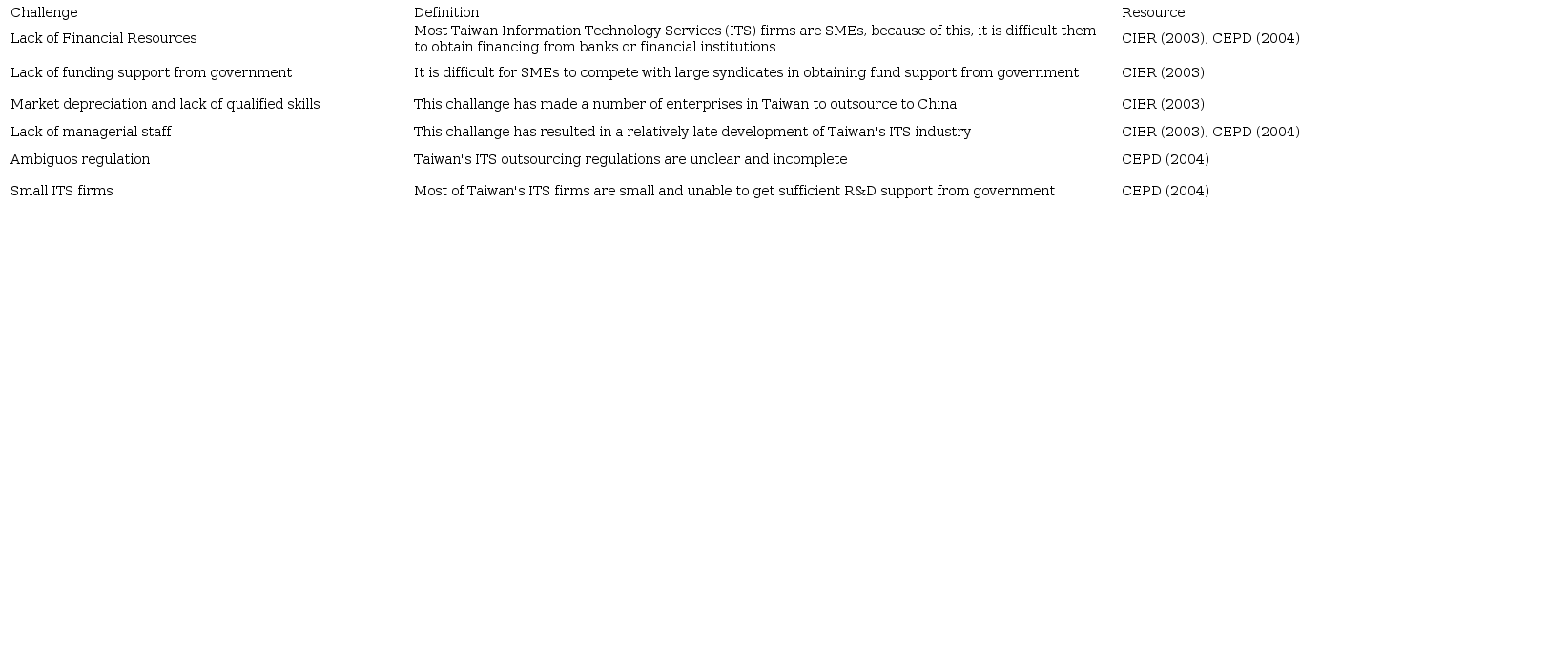

Semi-structured interview is used to collect the informations. The responses of the managers of 17 companies are evaluated. 7 of these companies are logistic service providers. The rest of these companies are from various sectors: communication, international trade, ship building and fast food sectors. The use of 3PL is surveyed and these services are diversified like customer service, lunch, service bus and any other. In Turkish companies it is common to give lunch to the employees. The lunch can be provided by the employees of the company or the employees of 3PL companies. The employees do not bring lunch to their company.

11 of the 17 respondent companies does not cooperate with an 3PL company. The services and the number of the companies using 3PL services are shown on Table 2.

3PL use of the respondent companies

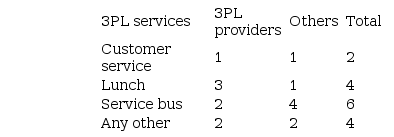

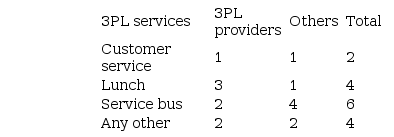

5 of the logistic service provider companies does not use 3PL services. %71,4 is the rate of avoiding 3PL services. 6 of the other companies does not prefer 3PL. %60 of these companies avoid using these services. The opinions of the respondent companies are also reviewed. The purpose was surveying the awareness of the synergy which may appear by using 3PL services. The number of the companies which accepted the mentioned opinions are shown on Table 3.

Opinions of the respondents

6 of the 17 companies accepted none of these opinions. 1 of the logistic service provider companies and 5 of the other companies did not accept any of these opinions. First opinion is explained like ?outsourcing can only bring loss to the company?. The second opinion is explained like ?If a company prefers outsourcing, then it does not have adequate ability for these services?. The third opinion is explained like ?Outsourcing is inevitable?. The fourth opinion is essentially the same with the first opinion and explained like ?It is not possible to provide any profit by outsourcing?.

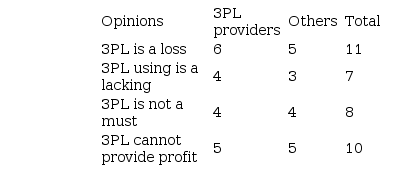

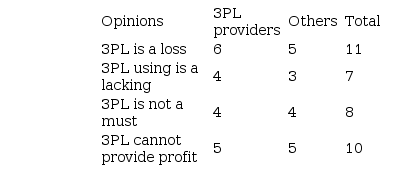

Outsourcing is strictly correlated with the size of the companies. Bigger companies need outsourcing more than the small companies. The number of the employees and their preferances of outsourcing is seen on Table 4.

Employee number of the companies and the outsourcing levels

Size seems to be one of the most important determinants of outsourcing in Turkey. There are five companies with more than 50 employees and one does not prefer outsourcing. One of the two companies which use 3PL firms hires a service bus with some other companies and the other company has a night duty.

Cost is the main concern of the logistic provider companies. There are many different ways of managing the costs. Cost management activities are not the responsibility of a separate department. The existing departments or the owners decide about the cost management activities. The main point they focus on to reduce the costs is decreasing the salaires or the wages of the employees. They try to reduce the wages in time. They admit that they attempt to pay lower and if it is accepted they keep on doing that. When there is a response or an inclination to change the job, then they offer higher salaries.

Two of these logistic provider companies support the operations of its customer companies by using some employees which does the same job with the employees of the customer company. Although these employees have the same duties, the employees of the 3PL companies are less paid.

Two of the logistic provider companies follow technology closely. These companies aim to focus on their brand equity. One of the other companies also focuses on brand. None of the 17 companies believe that a freight village will be beneficial for them. But all of them agrees that freight villages have a contribution to the society and the logistic operations. They also admit that they do not have any idea about the infrastructure of the freight villages which are already built or being built in Turkey.

The logistic operations are mostly done by the companies themselves. The Turkish logistic sector has a significant capacity to grow. But demand is the main constraint of the growth of logistic sector. The corporations must discover the power of outsoursing and they must tend to recruit logistics companies more than before. This will increase the demand and the potential of the logistics companies. With the increasing potential, the logistics companies will be able to decrease their costs and to offer lower prices. The reduction on the prices end up a decrease on the total costs of the companies which can increase the profits of them as well.

Outsourcing demand does not seem to be adequate to create logistics companies with huge scales. Lack of scale economies mean a lack of contribution to the cost management. 11 of the 17 companies avoid outsourcing. In other words %64,7 of the surveyed companies do not demand outsourcing. The supply chains cannot be improved without the improvement of logistic sector.

The traditional management understanding still seems to be existing. Because the owners claim that buying the vehicles is more advantageous. The money, which is paid for the logistics companies, goes out of the window. They defend that such contacts are not beneficial without making any financial analysis. But computing the depreciation, costs and other variables and a comparion which cam be done in the light of these computations is necessary to reach such an opinion.

The most important reason of correlation between the size of logistics companies and demand arised after this survey. The Small and medium sized enterprises (SMEs) have their own advantages, such as flexibility and agility, but the correlation between the size of the Turkish companies and the outsourcing demand is still important. As the size of the Turkish logistics companies can grow with the increasing outsourcing demand, the logistics companies will operate ore efficiently and they will have the chance of professionalizing on their operations. The high number of SMEs and the small number of huge corporations is the reason of inadequate outsourcing demand. The corporations are not attracted by the prices offered by the logistics companies. But they still do not have the capability of proposing lower prices. This situation creates a cycle.

Mergers, strategical alliances and joint-ventures are not common in Turkey. The mergers can create synergy. The synergy, which is an additional value, is necesary to trigger the growth of logistics sector. If the cycle of growing starts, the logistics companies will expand faster ad they will respond to the needs of business life easily. The SMEs enjoy their flexibility. Unlike the huge corproations, which cannot appear easily, the SMEs can be formed easily whenever they are needed. SMEs cannot always unificate to form bigger enterpreneurships. But they can make strategic alliances. Such agreements are necessary to make colloboration which can provide power to the companies to take bigger businesses. The bigger corporations can be formed by the unions. It is not rare to see unions in the logistics sector. They are are necessary to assist the improvement of the logistic sector. For example, the freight villages cannot be constructed and operated without huge corporations.

Outsourcing challenges for Taiwan

Tseng, Sheng-Ying. (2009). Strategic positioning of Taiwan in the outsourcing market: Evidence from information technology services and electronic manufacturing outsourcing to China, Florida International University.

3PL use of the respondent companies

Opinions of the respondents

Employee number of the companies and the outsourcing levels