Low-cost bus business models and the case of Brazil

Revista de Gestão, vol.. 27, no. 1, 2020

Universidade de São Paulo

Abstract:

Abstract

Purpose

The purpose of this paper is to identify low-costbus business models from different parts of the world and check their applicability in the Brazilian market. It also identifies crucial factors for the development of that kind of business and investigates the relationship between low-cost buses and other modes of transport. This research analyzes every relevant aspect to the applicability of low-cost business models in Brazil, driving to discussions and conclusions. The gains on the development of low-cost bus systems in Brazil may have a wide reach, from personal to general public benefits.

Design/methodology/approach

Business models for low-cost bus systems are used to analyze in a qualitative approach. The data are collected through semi-structured interviews, direct observations and documental basis. In addition, innovations over the previous five years are evaluated in order to establish a comparative pattern between companies.

Findings

There is a great potential in the Brazilian passenger market for the entrance of low-cost bus companies. The only question is just when it is the right time to enter that market. Most of the negative points presented for the implementation of a low-cost company are related to the current economical and political crisis in Brazil. It was identified as a potential cause for the overall decrease of the passengers market in recent years, and specifically of the bus passengers market.

Originality/value

The recent regulation changes, the high demand for passengers and even the similarity of possible routes in Brazil to the ones in Europe and in the USA make Brazil a fertile soil for the development of that kind of business. A similar price mechanism to the ones applied worldwide was also identified as doable in Brazil.

Keywords: · Business models · Transport policy · Bus market · Low-cost bus.

1. Introduction

Brazil is a country with continental dimensions, in which transport integration plays a major role. Transportation is essential to the dislocation of the population between cities, being a highly significant activity to the economic construction and the social development of the nation. It contributes to create jobs, to a better income distribution and to shorten distances, bringing gains for the country and granting the population access to goods and services.

In this context, buses play a major role in Brazil, transporting around 50m people each year in regular intercity routes (ANTT, 2017). The scenario of bus transportation in Brazil is characterized by increasing competition, with changes in the regulation beginning to lead to a free market. However, the absence of good road conditions generates high costs of operation for the transport companies, mainly because of the constant maintenance of vehicles, burst tires and higher fuel consumptions. Because of that, prices usually are high for customers and many people do not have conditions to afford traveling in Brazil.

In parallel, the idea of low-cost services stepped up. That kind of business operates based on cost cutting, increasing utilization and earning extra profits from every possible source (Berster & Wilken, 2005; Bitzan & Peoples, 2016; Maertens, Pabst, & Grimme, 2016; Lu, 2017).

Specifically for the bus sector, the low-cost services are showing amazing performance around the world. On the other hand of the traditional bus industry, the low-cost bus operators in Europe and North America are having huge growth rates in the number of passengers, routes, revenue and profit. Megabus, the first company to apply the low-cost concept to buses, saw passenger numbers in the UK grow 150 percent from 2009 to 2013, while customer journeys in mainland Europe grew 60 percent in only 12 months between 2014 and 2015 (Stagecoachbus.com, 2015).

However, the application of low-cost businesses around the world is strictly related to the bus deregulation processes. Even though Brazil is not deregulated – Brazilian agencies modified the regulation aiming to a market based on the free competition. The first step to the application of a low-cost bus system in Brazil was made.

In this way, the purpose of this work is to identify low-cost bus business models from different parts of the world and check their applicability in the Brazilian market. It also identifies crucial factors for the development of that kind of business and investigates the relationship between low-cost buses and other modes of transport.

This research analyzes every relevant aspect to the applicability of low-cost business models in Brazil, driving to discussions and conclusions. The gains on the development of low-cost bus systems in Brazil may have a wide reach, from personal to general public benefits.

For this, the paper is divided into five topics. After this introductory topic, the literature review is presented in order to better understand the concept of low-cost and its transition to the bus market. The bus markets in Europe and in the USA were analyzed and a research on regulation was made, given the importance of that factor in the development of bus systems. Finally, low-cost bus business models around the world were characterized and discussed.

2. Literature review

2.1 The low-cost bus market

“Low-cost” is a term that refers to a strategic orientation in which a company tries to cut costs at all levels of the organization, generally including a market campaign focused on the discounted prices. To apply a low-cost strategy, a company continuously analyzes and controls its most important costs and does an efficient asset management. To do so, there must be a special attention to distribution and communication in addition to the pricing policy (Berster & Wilken, 2005; Groß & Schröder, 2007; Dobruszkes, 2009; Bubalo & Gaggero, 2015; Bitzan & Peoples, 2016; Maertens et al., 2016; Lu, 2017).

According to Berster and Wilken (2005), the main goals of the low-cost strategy to reduce costs, increase utilization and earn extra profits from every possible source can be achieved by doing the following:

1. utilizing yield management as a tool to conduct price and capacity and to highlight low costs;

2. optimizing costs in all business areas, such as staff costs, service costs and maintenance goals;

3. standardizing production and services;

4. selling directly to the final consumer in order to avoid commissions and transmission costs;

5. charging for every service, no-frills; and

6. utilizing assets to earn extra profit, such as selling space for advertising.

Based on the above points, it is possible to understand that low-cost companies started to take the market and offered significant competition against traditional players. Furthermore, these companies were also responsible to bring a completely new niche to the market, people who were first excluded from it due to low-income availability.

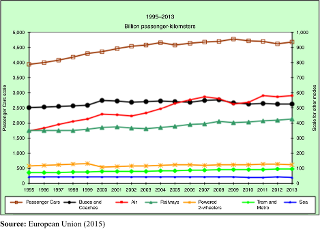

Today, low-cost companies are very related to travel and tourism, being present among hotels, such as Formule 1 and EasyHotel, and all kinds of transportation, from ships to huge airline companies, such as Southwest and Ryanair. In recent years, the bus industry in Europe is flat, alternating small growths and shrinks, as we can see in Figure 1.

The USA follow the same trend, where the passenger kilometers traveled also alternates positively and negatively. Some variations in the oil and gasoline prices are responsible for slightly changes, especially in the last years (Stagecoachbus.com, 2015).

However, following the deregulation of the bus market, Germany saw the number of passengers jump from 8.2m in 2013 to 16m in 2014. In France, the government estimates that the 110,000 passengers in 2014 will become 5m by the end of 2016 (Stagecoachbus.com, 2015). So, if the liberalization trend continues, there must be more space for the bus carriers in mainland Europe.

Despite the potential growth, there is a tough competition faced by the whole industry, what is driving both turnover and profit to a critical minimum. Line operation was very limited in most countries until the last years. Many countries, such as France and Germany, did not allow bus lines running in parallel with railway services (Alexandersson, 2009; van de Velde, 2009; Augustin, Gerike, Martinez Sanchez, & Ayala, 2014; Blayac & Bougette, 2017), until the deregulation of their bus markets, in 2013.

Cars represent more passenger kilometers traveled than twice the combination of all the other transport methods. Another huge competitor is the low-cost airlines, which are extending routes to new places every year. Tour operators are also important, because they can organize single trips without official permission or route license. And finally, the bus companies compete between themselves, always trying to succeed in a very limited market.

For buses, the presence of low-cost carriers was only possible with the deregulation of the bus market. Intercity bus traveling was still strongly regulated in most western European countries in favor of the railway companies. The exception to it was the Great Britain bus market, which deregulation started in 1980 and allowed the creation of the first low-cost bus company in 2003, Megabus (White, 2010; White & Robbins, 2012). On the other hand of the traditional bus industry, the low-cost bus operators in Europe and North America are having huge growth rates in the number of passengers, routes, revenue and profit (Buehler & Pucher, 2012). In continental Europe, with the liberalization of the bus market in potential markets, such as France, Germany and Italy, the mileage is expected to four fold year-on-year (Stagecoachbus.com, 2015). By the way, in Europe long-distance bus services were always secondary when compared to other transportation methods. Railways or airlines attract much more political and media attention, are more visible and require much more infrastructure investment, especially from public sources (van de Velde, 2009; Santos, Limbourg, & Carreira, 2015; Zuidberg, 2017). However, in countries where the deregulation was appropriately implemented, allowing competition, coaches became responsible for the mobility of the less-wealthy and time-rich citizens (van de Velde, 2009; White & Robbins, 2012; Preston & Almutairi, 2014; Dürr & Hüschelrath, 2017). This is consistent with the evidence of very low incomeelasticity for coach travel in comparison with other modes. The results of Dargay and Clark’s studies show that long-distance travel is strongly related to income: air is most income-elastic, followed by rail, car and finally coach. The concept of low-cost bus is strictly related to the regulation of markets, because the free competition opens possibilities for really narrow margins. In order to obtain market share, even traditional companies have to lower their prices and the full implementation of the low-cost strategy grants some competitive advantages to its players. More recently, the entrance of low-cost operators in some countries is taking place immediately after the deregulation of the markets (White & Robbins, 2012; Preston & Almutairi, 2014; Dürr & Hüschelrath, 2017).

2.3 Regulation in Brazil

The economic activity related to the Interstate Road Transport of Passengers (TRIP – Transporte Rodoviário Interestadual de Passageiros) has always been regulated by the Brazilian government in almost every aspect: entry of new companies, qualitative and quantitative aspects of the service execution, and mechanisms of prices and rates.

Since the promulgation of the 1988 Federal Constitution, the entry of new players in the TRIP markets has not been depending exclusively on the will or capabilities of a company. To operate a TRIP line, the firm needed a grant permission, which could only be earned through a bidding process. However, resolutions in the regulation are opening space to a more competitive market.

The Decrees that regulate the TRIP established October 2008 as the final deadline for the permission contracts of the sector. Since then, the service has been done based on special authorizations issued by ANTT. Also some judicial decisions have been allowing the continuous exploration of some lines that were not covered by the Agency’s authorizations.

From 2008 to 2014, the government tried to choose companies to operate a group of routes through bidding processes. The idea was to offer groups of routes that included high profitable lines, but also some that would not grant profits. In this way, better routes would pay off the worse ones and the model would give a better integration for small cities. In this highly regulated model, the ANTT was responsible for determining how many routes would attend each city, the timetable and the prices. Due to the regulation suppressing the open market between the carriers, the interstate transportation did not experience a fare reduction during these years.

However, changes started to occur in 2014, when the Law 12.996, sanctioned on June 18, updated the whole model. The biggest change was related to the Article 13 of the Law 10.233/01. The new law allowed the interstate passenger transportation services to be granted as authorizations, like it already happened in many other countries.

Finally, from 2015, the Resolution 4.770 regulated all the system. Companies would not have exclusive lines, which means that many carriers could ask authorizations for the same line; maximum prices must be obeyed, but there would not be fares, letting the companies to set their own ticket prices. Among the demands for the companies to earn an authorization are:

1. legal regularity;

2. no legal labor problems;

3. tax compliance;

4. financial capacity;

5. experience in the passenger transportation sector;

6. vehicle inspection once a year to check the emissions of pollutants;

7. appropriate garages and footholds;

8. fleet monitoring system; and

9. maximum age of each vehicle must be 10 years of use and average age of the fleet shall be 5 years.

The change in the TRIP market is being controversial by some agencies and by the media. The government and most of the competitors believe that, with the open market, the services tend to improve, bringing more benefits to the users, such as lower prices and better quality (e.g. investments in more modern and comfortable fleets).

The break of the lines and routes limitations gives the companies an alert to review what they offer today to the public and what they could offer as a differential to attract more customers. On the other side, there are some companies and agencies that believe the new system is going to harm small cities, generating a lower offer of lines and higher prices.

The main differences between Brazilian’s new system and most of the European deregulated countries lie on some financial, infrastructural and qualitative aspects. Financially, there will be a maximum ticket price defined by the government for the following five years, in order to avoid prejudices to the passengers, while studies about demand and costs are done; in what concerns the infrastructure, companies will need well-structured bus terminals to serve as bus stops, and the government do not want it to be a limitation for the market, so there must be construction of both private and public terminals in the next years; and qualitatively, the Brazilian Government has a lot of rules on the hygiene of the buses, frequency of breaks, late departures, bus stops, among others, and grants a lot of consumer rights related to ticket issue, ticket exchange, late departures, etc.

3. Business models for low-cost bus systems

This section will present low-cost business models found around the world, in order to have an overview on how they work, how to better implement them and how to maintain such systems. Companies from America, Europe and Asia were analyzed and presented very different approaches for the business, which will be explained and discussed. Specific characteristics from each model were identified: companies can be divided in public, private and state-owned; their business models vary from some very operational approaches to others totally focused on the strategic management. Each singularity will be analyzed in eight different low-cost bus business models.

3.1 Megabus model

Megabus is a low-cost intercity coach service subsidiary of the huge English company Stagecoach Group, which gave the company financial resources to withstand an unprofitable period of operation until demand for its services built up. It started in the UK in 2003, entered the USA market in 2006, and has expanded throughout mainland Europe (Stagecoachbus.com, 2015).

The company was the first one to see that the aggressive cost-cutting airline business model could be implemented for the intercity bus service. First, to reduce costs, Megabus works with reduced personnel, with employees playing many roles. For example, the driver is also responsible for checking tickets, announcing stops and packing the luggage. Also, the company only sells tickets via internet or phone, another way to reduce costs (Stagecoachbus.com, 2015).

The main characteristic of Megabus is the yield management, which, according to Netessine and Shumsky (2002), is a pricing strategy that anticipates and influences consumer behavior in order to maximize revenue and profit. For that, it used variable pricing, in which bus seats are sold at different prices depending on the time they are sold.

According to Stagecoachbus.com (2015), the Megabus business model is designed to be sufficiently flexible to respond to development in the market and changes in demand both in Europe and in the USA. The key features are:

1. decentralized management structure, in order to local management quickly respond to local market variations;

2. light regulated bus operations, allowing management to vary prices, operating schedules and timetables in response to developments in each local market; and

3. flexible cost base, in which operating mileage and operating costs can change according to the demand.

Main points: yield pricing, variable management, cost cutting, no-frills.

3.2 Flixbus model

Flixbus was founded in 2011 in Germany, but only launched its first route in 2013, after the German bus market deregulation and the end of the rail monopoly (Flixbus.com, 2016). The company’s speed of expansion was and is impressive. Already in 2014, Flixbus was all over Germany, with a robust network. In 2015, after the merger with the competitive startup MeinFernbus, it became the national market leader, detaining 71 percent of the roadmap kilometers (Iges.com, 2016), what gave it strength to the international expansion. The company opened subsidiaries in Milan and Paris and, in 2016, it expanded to central and Eastern Europe, as well as Spain and the UK (Flixbus.com, 2016).

According to Engert (2014), Co-founder of Flixbus, the company is “like the McDonalds out there.” Flixbus does everything related to the product: scheduling, network planning, bus branding, marketing, communications, sales, IT, ticketing and all the service toward the customer.

However, the company does not own any bus, since the bus driving part happens together with the local partners. They are medium-sized private companies throughout Germany – over 50 companies across the country – that do the operations for Flixbus. These companies bring in the assets, the drivers, they drive the buses and they deliver the product the way Flixbus wants them to deliver. All these companies act like franchisees, allowing Flixbus to scale faster and with less capital than it would have needed to do so with its own drivers and buses.

On top of that, the company has a revenue sharing model, basically to share the risk of not so profitable routes with the operators. So, once a line goes very well, the operators are going to be very profitable. Once it is not going so well, Flixbus is going to share the risk of utilization with them. With that in mind, it is easier to grow the network. And that lets the company with a great incentive to do good marketing, to do good sales, and it provides the operators an incentive to deliver good quality service, with friendly drivers (Engert, 2014).

In the year of 2015, 20m passengers traveled with Flixbus. Many routes have the €1 tickets for the first buyers. As of today, the company is reaching a total of 100,000 daily connections to 800 destinations in 19 countries, being Europe’s largest long-distance bus network (Flixbus.com, 2016).

Main points: “Franchise” business model, revenue sharing, risk sharing, network expansion.

3.3 Simple express model

While we see Megabus and Flixbus operating all over Europe, Simple Express is characterized by a more regional approach. The company belongs to the Lux Express Group and operates mostly in the Baltics, with some links to Russia. In its routes, the company did not have low-cost bus competitors until September 2015, with the arrival of SuperBus (Superbus.com, 2016).

Lux Express was already known for its low prices and the great comfort for its customers. Simple Express has even low prices, and the comfort for the trips is the same: coaches have Wi-Fi, bathroom, comfortable reclining seats, outlets for each pair of seats and even individual touch screen media devices, with movies, series, games, music and internet (Luxexpress.eu, 2016). The only difference to Lux Express is that there is less leg space and no free coffee. Also, the routes are still few, reaching only the main cities.

The business model of the group is based on attracting people for long journeys based on pricing and comfort. Some adjustments were made to fit more people in each bus and there is a yield pricing strategy, with tickets starting at €3. In order to cut costs, the tickets are sold online, but also by the driver if there are free seats. For the whole group, the 2015 results showed impressive 1.9m passengers transported and an increase of 15 percent compared to the year before (Luxexpress.eu, 2016).

Main points: yield pricing, regional, comfort.

3.4 Other high quality models

In Europe, some companies, like the Polish PolskiBus, the Finnish OnniBus and the Estonian SuperBus, do not see low cost and high quality as opposites. They all belong to the same group – Highland Global Transport –, focus on their national markets and use marketing as a way to reach more customers in routes that other low-cost operators do not have. The stops are usually in the street and, for many routes, the customer has to sign for the bus to stop.

PolskiBus sells tickets starting at 1 zloty, or 25 euro cents, connects 34 cities in Poland and recently has expanded its network to 7 other international locations. Since 2011, the company has carried more than 14m passengers (Polskibus.com, 2016). OnniBus was created in 2014, already connects over 40 cities in Finland and sells tickets from €1, while SuperBus started in 2015, connects 5 cities in the Baltics and also sells tickets from €1 (Onnibus.com, 2016; Superbus.com, 2016).

Main points: yield pricing, group, regional, quality.

3.5 Eurolines/Baltour model

Eurolines is a network of 29 co-operating coach companies from all over Europe offering connections and integrated ticketing. Baltour operates in Italy for more than 50 years and controls 100 percent of Eurolines Italia (Eurolines.it, 2016). With low-cost companies spreading around Italy and the whole Europe, Baltour started to sell tickets for €1 and is using it as marketing to attract more customers. The company is an example of traditional operators that only lower their prices in order to stay competitive, even though their business models stay the same.

These kinds of operators are bringing profit to a critical minimum, trying to compensate lower prices with a higher volume. However, Eurolines has a very well developed network, reaching over 1200 destinations (Eurolines.it, 2016), which still gives to its members some competitive advantage.

Main points: traditional service, marketing, network.

3.6 BoltBus model

BoltBus was created in 2008 in the USA by the gigantic Greyhound, a bus company with over 100 years of experience in America (BoltBus.com, 2016). BoltBus was an answer to Megabus arriving in the USA and the comeback of the bus market, with some characteristics that Greyhound had not had before.

In order to act faster and not to lose the biggest markets to competitors, Greyhound created a new brand highly focused on quality and ease of use. The branding idea was not to relate the new company to the parent company and its old well-known issues, targeting a whole new niche in the bus market. For example, BoltBus, unlike Greyhound, insures that all tickets sold are for reserved seating and that there will be no overselling (BoltBus.com, 2016).

According to BoltBus.com (2016) website, the business model of the company includes tickets starting at $1, with online sales, and the prices are controlled via the yield management model. It is possible to buy tickets from the bus driver, but they are 30 percent more expensive than the online price. In order to cut costs and ticket prices, buses do not operate in the main stations. And, unlike other low-cost companies, BoltBus has a loyalty program, which rewards frequent clients with early boarding.

BoltBus operates a fleet of 101 buses in the northeast region and in the west coast (BoltBus.com, 2016). The company, aside with Megabus, saves consumers $1.2bn annually compared to other models of trips that travelers indicate they would use if these bus services were not available.

Main points: branding, yield pricing, loyalty program.

3.7 Southeast Asia model

The lack of regulation in some Southeast Asia countries, even with respect to safety, makes possible a low-cost approach for the bus system. Traveling by bus around Thailand, Cambodia, Laos and Vietnam is by far the cheapest way, compared to the existing trains and even low-cost airlines.

The business models vary from country to country, but they are always focused on the locals and on tourists traveling with a low budget. There are mainly two of them:

1. Companies controlled by the government, like the Thai bus operator Baw Khaw Saw, which sells tickets at the bus terminals for a cheap price, usually travels during the day, packing as many people as possible inside the bus (not necessarily seated), and stops often, slowing considerably the trip time.

2. Private companies, such as the Cambodian Mekong Express, which sells express services to long-range destinations, through local travel agencies. The routes are both during the day and overnight, and the carriers offer a more comfortable service, many times with beds onboard (Catmekongexpress.com, 2016).

Main points: volume, many stops/local travel agent selling, comfort.

3.8 Vietnam model

The low-cost bus business model in Vietnam is only possible due to the lack of regulation in the country. Traveling Vietnam by bus is very cheap and convenient. The main competitors are trains, which are very slow, more expensive than buses and do not reach some important cities, like Hoi An. However, they insure more safety than traveling on the road. Low-cost airlines also offer competition, but they are more expensive and restricted to very few cities.

The whole business depends on travel agencies and hotels, which sell the tickets mostly to low-budget travelers and locals. The customers are always picked up directly from their accommodation, or from the travel agent where they have booked their ticket. The driver then has to drive through heavy traffic to different hotels and travel agents, picking up more passengers, so it takes quite a while before the bus gets officially on the road. Due to the usual long-distance and time traveled, the buses are single decker with three rows of bunk beds through it. Many times, the beds are reserved for tourists and many locals pay even less to sit on the aisles, so the companies earn additional revenue. Traveling Vietnam by bus has the added bonus of a free night’s accommodation on any overnight bus journeys, as well as a door-to-door trip.

According to Sleeperbusvietnam.com (2016), one of the few with online selling, the greatdifferential of using bus, especially for tourists, is the possibility of traveling with an open ticket, also called hop-on hop-off. Companies sell the routes south-north and north-south in which it’s possible to stop in a range of cities before the final destination, where the customers can stay for as long as they want. Usually, the customers only have to reconfirm when they are traveling the next route with advance at the company’s booking office. Most of the times, the prices reflect on the comfort the passengers get.

Main points: local travel agent selling, long trips, overnight, hop-on hop-off.

3.9 Overview

Based on the description of the above companies, and accordingly to Groß and Schröder (2007), it is possible to identify different types of low-cost implementation:

1. companies that fully implement the low-cost strategy, applying techniques to reduce costs, increase utilization and earn extra profits from every possible source;

2. companies that partially implement the low-cost strategy or implement some elements of it; and

3. traditional operators that only lower their prices in order to stay competitive.

Furthermore, it is possible to see a totally different approach in Southeast Asia, which is only possible with the lack of regulation for road trips in some countries, even related to the safety of passengers.

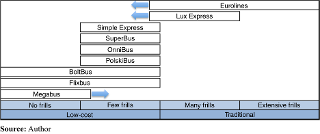

It is becoming more and more difficult to separate the carriers between these categories and, many times, companies identify themselves in marketing campaigns as low-cost only to attract customers. Figure 2 identifies trends in each of the above listed companies and to place them accordingly to the low-cost level they have implemented.

4. Research method

The method of case study is appropriate because the research goal is to investigate an emergent phenomenon over which the researcher has no control; that is, to identify low-cost bus business models from different parts of the world and check their applicability in the Brazilian market and also identify crucial factors for the development of that kind of business. To Choudhari, Adil, and Ananthakumar (2012), the fundamental goal of a research that uses case studies is to decrease the distance between theory and practice.

According to Yin (2003), there is no consensus on the ideal number of companies in a case study: a single case or multiple cases. The study of multiple cases is better suited to the research proposal and the researched companies were selected based on the importance of selected companies within the low-cost bus market.

The main goals of this research are to identify different business models for low-cost buses and to check their hypothetical introduction in the Brazilian transport market. In order to achieve these objectives, a methodology consisting of six main steps (Figure 3) was followed not only for the Brazilian market:

1. Analysis on economy, politics, regulation and law:

o general aspects for the country;

o specific aspects for the bus market; and

o risk analysis.

2. Identification of potential corridors:

o demand in Brazil;

o route distances and times; and

o road quality.

3. Identification of suitable business models:

o general qualitative information; and

o selection of similar corridors in Europe and in the USA.

4. Information collection on business models:

o data collection;

o understanding yield management pricing; and

o benchmarking on selected companies.

5. Identification of competitors and substitutes:

o data collection;

o comparison to low-cost buses; and

o benchmarking on transportation methods.

6. Costing and pricing in Brazil:

o pricing based on comparison with benchmark of competitors and substitutes in Europe and in the USA;

o costing of business in Brazil; and

o Pricing using cost-plus model to crosscheck of values.

5. Applicability of a low-cost bus business model in Brazil

The subject of low-cost bus is still not widely studied and very few scientific articles about it were developed. Also, those articles in which the topic is presented usually are not focused specifically in the low-cost bus business models, but only in setting demand comparisons against traditional competitors. Most of those studies bring the example of Megabus, which was the pioneer in this kind of business, starting in 2003, in the UK.

One important point brought by the literature review is about the relationship between the deregulation of transports and the appearance of the low-cost bus companies. Megabus started in the UK because the bus deregulation had already happened in 1980. In 2006, the company extended its business to the USA, which also had its deregulation in the 1980s. Finally, the low-cost bus only spread throughout Europe in the recent years, with the deregulation of some major countries. Overall, the importance of the deregulation is mainly related to two factors: bus companies could not choose their routes before, especially because of the presence of state-owned trains; and, when operating some predetermined routes, companies should follow specific schedules and a table of prices. With that being said, the Brazilian deregulation would be a key aspect for the implementation of a low-cost business model.

Based on that, one of the first analyses made was focused in the current regulation in Brazil, and the results were favorable: even though the bus market is not totally deregulated, since 2015, the new regulation started to allow many carriers to ask authorizations for running lines that previously worked only through concessions. For that, maximum prices must be obeyed, but there would not be fares, letting the companies to set their own ticket prices. This new regulation is opening the market to a free competition and the timing to apply a low-cost bus business is perfect.

Before leading to a more specific analysis about the bus market in Brazil, some general information about the country’s economy and politics was gathered. The results were not very encouraging, since Brazil is facing one of the worst crises of its history, with a huge recession, a lot of instability and bad results in almost every economic sector.

In order to better understand the market in which a low-cost bus would be inserted in Brazil, it is important to show that cars, buses and airplanes basically run the passenger transportation in the country, with no presence of trains. The focus of the study was in the public transportation – buses and airplanes –, which accounts for almost 150m passengers transported in 2015. It was possible to notice that the overall market of passengers decreased in the last couple of years, possibly because of the economic crisis. Especially, the bus market shrunk 15.5 percent in two years, coming to 48m passengers being transported in 2015.

Focusing specifically in the bus market, the main corridors of demand were analyzed. The analysis of the transportation flow was realized in two different ways: through methods that aim the measurement of the absolute density of the connection between two states (or regions), considering departures and arrivals for both of them (Wang & Jin, 2007); and by identifying the number of passengers in departure or arrival by each state (or regions) (FIPE, 2010). The first approach identified the main corridors between regions and states, and their variation in a three-year interval. The second method identified the regions and states with the most passengers departing and arriving. Both techniques showed that the Southeast region is the one with the greatest market, representing more than half of the passengers transported in Brazil.

Based on that analysis, five routes were selected: three in the Southeast region, one linking the Southeast region to the South region and one in the Northeast, which was the only region with a considerable number of passengers to face a growth of customers in recent years. Apart from the demand, analyses on the population, quality of roads and presence of students corroborated to the selection of these five specific routes.

The next step of the research tried to see how plausible those routes would be for a low-cost bus business. In order to do so, similar routes from the companies identified in the literature were analyzed. The literature review found many bus companies with a low-cost approach around the world. They are present in Europe, in the North America and in Southeast Asia. The carriers in Southeast Asia were discarded for further analysis, due to the lack of safety and quality in their services. Among the European and American companies, three of them were selected to be compared to the Brazilian routes: Megabus Europe, Flixbus and Megabus US. The comparison showed that some of the routes in Brazil were too long when compared to the ones in Europe. However, very similar long routes were found in the USA. The most common routes found in all the three companies were the ones linking two big cities not so far from each other (400–700 km), always having some partial stops, in order to maximize the demand of passengers.

Based on that, the two most common Brazilian routes were selected: Rio de Janeiro – São Paulo and Belo Horizonte – São Paulo. Each one of those routes had already been compared qualitatively to other three routes: one from Megabus Europe, one from Flixbus and one from Megabus US. The next analysis tried to better understand how the pricing of those routes work. The literature review explained that low-cost companies constantly use the yield management pricing, a variable pricing strategy, based on understanding, anticipating and influencing consumer behavior in order to maximize revenue or profits. It was possible to identify the price variation accordingly to the demand and the time, and this point was very relevant to the next steps of this work.

The next part of the research focused in finding a plausible price for the selected Brazilian routes. A low-price is mandatory for the applicability of the model, especially in comparison with the traditional buses in Brazil. In order to make this analysis, the price of those routes was calculated in two different ways: by comparison with competitors and using the cost-plus method.

For the first price analysis, a benchmark was created through the comparison of prices between low-cost bus companies and their competitors and substitutes: traditional buses, trains, airplanes, cars and car-sharing services. In Europe and in the USA, 28 routes from 6 corridors were analyzed, and a proportion of prices was found. Based on that benchmark and in the prices of competitors and substitutes for the Brazilian routes, the prices of the low-cost buses were estimated. However, the only way to check if those prices were plausible was through a cost-plus analysis. That method was used and the prices found depended on the average occupation of the buses, leading to the conclusion that the proportion of prices between low-cost carriers and their competitors and substitutes could be kept, as long as those companies manage to run routes with high occupation percentages. Only 35 percent of a 50-seat bus occupation is enough to allow a pricing proportion as found in the benchmark to traditional buses. Half of the occupation would be needed to keep the relative price against airplanes.

Finally, in what relates to the implementation of low-cost buses in Brazil, business models identified in the literature review were consulted and a similar approach was taken. Specifically, the Flixbus method was more explored, since the company runs without having any bus and only being responsible for the strategy and administration of routes and clients. The great idea of the company was to focus on small charter and school bus companies and then attract them to run regular city-to-city buses under the Flixbus brand as subcontractors. In that way, local partners own the buses and employ the drivers, being responsible for all the operational tasks. Based on that, a whole analysis on eventual charter buses was made and it identified a great presence of those companies in the locations of the selected Brazilian routes. Also, most of these companies are considered small, what was identified in the literature review as a potential target for the Flixbus franchising approach.

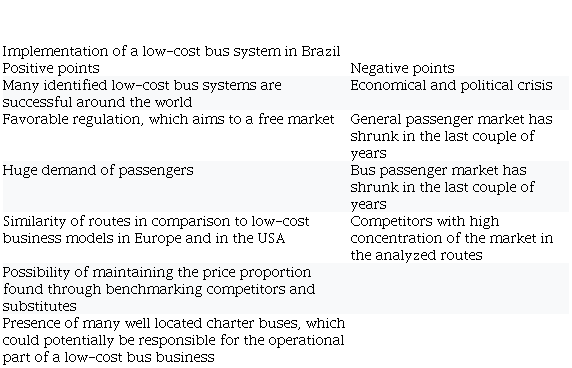

Table I summarizes the positive and negative points for the implementation of a low-cost bus system in Brazil.

6. Conclusions

This study aimed at assessing the applicability of a low-bus business model in Brazil, by following a sequence of actions and analyses identified in the literature review as relevant.

As analyzed in this report and discussed in the previous section, there is a great potential in the Brazilian passenger market for the entrance of low-cost bus companies. The only question is just when it is the right time to enter that market. Most of the negative points presented for the implementation of a low-cost company are related to the current economical and political crisis in Brazil.

Other negative points are strictly related to the previous market model in Brazil. The partial liberalization of the airplane market in Brazil, in 2003, granted many advantages to air carriers, while bus companies were stagnated in an antique concession-based model. That situation was also responsible for building big players in the transport market. Only in 2015 the bus market started to head for a free competition. Also, starting a low-cost bus company from scratch could be risky, because of the high concentration of the current companies in the bus market. Those companies could replicate the low-cost business model, and, if they react quickly, it is possible that new low-cost companies would not find space to grow.

But then, many positive points were identified in the literature review and in the analyses made, which showed a great potential for the low-cost applicability in Brazil. Low-cost companies have successfully faced huge monopolistic companies around the world, bringing a whole new dynamic to the market. Megabus in the UK became a great competitor to National Express; in the USA, the gigantic Greyhound was forced to open a low-cost branch in order to retain market share.

The regulation changes, the high demand for passengers and even the similarity of possible routes in Brazil to the ones in Europe and in the US make Brazil a fertile soil for the development of that kind of business. A similar price mechanism to the ones applied worldwide was also identified as doable in Brazil.

Additionally to that, the two biggest low-cost bus business models worldwide – Megabus and Flixbus – were considered plausible of being implemented in Brazil. The first one requires a higher initial investment, while the second one is more strategic and needs the presence of third party operators, which are present in Brazil.

Future analyses should focus in better understanding how the Brazilian market is working after the new of regulation, since, one year after its change, the pricing strategies and route scheduling seem to be working in the same way, with very few new competitors in the market. Especially when Brazil starts to grow again, this subject must be reanalyzed to understand the new dynamic of the passenger bus market.

The exploration and comparison of new routes in Brazil is suggested as a follow-on study. With more routes being analyzed in Brazil and around the world, better conclusions could be inferred and a more accurate benchmark of low-cost companies, its competitors and its substitutes could be done.

Finally, the acquisition by Flixbus of Megabus retailing business in mainland Europe requires further analysis. The transaction, completed in July 2016, made Flixbus even bigger, and changes in the low-cost bus market may be observed.

References

Alexandersson, G. (2009). Rail privatization and competitive tendering in Europe. Built Environment, 35(1), 43–58. Available from: http://org/10.2148/benv.35.1.43

ANTT (2017). Relatório anual 2016. Agência Nacional de Transportes Terrestres, Brasília. Available from: www.antt.gov.br/backend/galeria/arquivos/Relatorio_Anual_ANTT_2016_diagramado_ASCOM3.pdf (accessed August 19, 2017).

Augustin, K., Gerike, R., Martinez Sanchez, M., & Ayala, C. (2014). Analysis of intercity bus markets on long distances in an established and a young market: the example of the U.S. and Germany. Research in Transportation Economics, 48(December), 245–254. Available from: http://org/10.1016/j.retrec.2014.09.047

Berster, P., & Wilken, D. (2005). Netzentwicklung, Markt-durchdringung und Verkehrsgenerierung der Low Cost Carrier Deutschlands im Verkehr Europas. Proceedings zu den 20, Verkehrswissenschaftlichen Tagen der TU Dresden, Dresden.

Bitzan, J., & Peoples, J. (2016). A comparative analysis of cost change for low-cost, full-service, and other carriers in the US airline industry. Research in Transportation Economics, 56(August), 25–41. Available from: http://org/10.1016/j.retrec.2016.07.003

Blayac, T., & Bougette, P. (2017). Should I go by bus? The liberalization of the long-distance bus industry in France. Transport Policy, 56(May), 50–62. Available from: http://org/10.1016/j.tranpol.2017.03.004

BoltBus.com (2016). FAQ. Available from: www.boltbus.com/faq.aspx (accessed May 12, 2016).

Bubalo, B., & Gaggero, A. (2015). Low-cost carrier competition and airline service quality in Europe. Transport Policy, 43(October), 23–31. Available from: http://org/10.1016/j.tranpol.2015.05.015

Buehler, R., & Pucher, J. (2012). Demand for public transport in Germany and the USA: an analysis of rider characteristics. Transport Reviews, 32(5), 541–567. Available from: https://dx.doi.org/10.1080/01441647.2012.707695

Catmekongexpress.com (2016). Mekong express. Available from: http://catmekongexpress.com/aboutus.aspx (accessed May 13, 2016).

Choudhari, S. C., Adil, G. K., & Ananthakumar, U. (2012). Exploratory case studies on manufacturing decision areas in the job production system. International Journal of Operations and Production Management, 32(11), 1337–1361, doi: 10.1108/01443571211274576.

Dobruszkes, F. (2009). New Europe, new low-cost air services. Journal of Transport Geography, 17(6), 423–432. Available from: http://org/10.1016/j.jtrangeo.2009.05.005

Dürr, N., & Hüschelrath, K. (2017). Patterns of entry and exit in the deregulated German interurban bus industry. Transport Policy, 59(October), 196–208. Available from: http://org/10.1016/j.tranpol.2017.07.014

Engert, J. (2014), Flixbus | Interview with Its Co-Founder Jochen Engert, Cleverism. Available from: www.cleverism.com/flixbus-interview-founder-jochen-engert/ (accessed July 27, 2014).

Eurolines.it (2016). Chi Siamo. Available from: www.eurolines.it/Chi-Siamo/13-1.html (accessed May 12, 2016).

European Union (2015), EU Transport in Figures: Statistical Pocketbook 2015, EU, Luxembourg. Available from: https://ec.europa.eu/transport/sites/transport/files/pocketbook2015.pdf (accessed May 12, 2016).

FIPE (2010), Resultados dos estudos relativos ao desenvolvimento de metodologia para estimativa dos investimentos e custos associados aos serviços regulares de transporte rodoviário interestadual e internacional de passageiros, Fundação Instituto de Pesquisas Econômicas, Brasília. Available from: http://propass.antt.gov.br/index.php/content/view/105714/Pesquisa_Ativos_e_Custos.html (accessed May 15, 2016).

Flixbus.com (2016). About us. Available from: www.flixbus.com/company/about-flixbus (accessed May 12, 2016).

Groß, S., & Schröder, A. (2007), Handbook of Low Cost Airline, Berlin: Erich Schmidt Verlag.

Iges.com (2016). Fernbusmarkt startet stabil ins neue Jahr. Available from: www.iges.com/presse/2016/fernbusmarkt/index_ger.html (accessed May 11, 2016).

Lu, J. (2017). Segmentation of passengers using full-service and low-cost carriers – evidence from Taiwan. Journal of Air Transport Management, 62(July), 204–216. Available from: http://org/10.1016/j.jairtraman.2017.05.002

Luxexpress.eu (2016). Traffic figures Q1 2015. Available from: https://luxexpress.eu/sites/default/files/quarter1_2015.pdf (accessed May 12, 2016).

Maertens, S., Pabst, H., & Grimme, W. (2016). The scope for low-cost connecting services in Europe – is self-hubbing only the beginning?. Research in Transportation Business & Management, 21(December), 84–93. Available from: http://org/10.1016/j.rtbm.2016.08.004

Netessine, S., & Shumsky, R. (2002). Introduction to the theory and practice of yield management. INFORMS Transactions on Education, 3(1), 34–44. Available from: http://org/10.1287/ited.3.1.34

Onnibus.com (2016). Information OnniBus. Available from: www.onnibus.com/en/about-us.htm (accessed May 13, 2016).

Polskibus.com (2016). Information PolskiBus. Available from: www.polskibus.com/en/about-us.htm (accessed May 13, 2016).

Preston, J., & Almutairi, T. (2014). Evaluating the long term impacts of transport policy: the case of bus deregulation revisited. Research in Transportation Economics, 48(December), 263–269. Available from: http://org/10.1016/j.retrec.2014.09.051

Santos, B., Limbourg, S., & Carreira, J. (2015). The impact of transport policies on railroad intermodal freight competitiveness – the case of Belgium. Transportation Research Part D: Transport and Environment, 34(January), 230–244. Available from: http://org/10.1016/j.trd.2014.10.015

Sleeperbusvietnam.com (2016). Sleeper bus Vietnam. Available from: www.sleeperbusvietnam.com/ (accessed May 13, 2016).

Stagecoachbus.com (2015). Annual report and financial statements. Available from: www.stagecoach.com/~/media/Files/S/Stagecoach-Group/Attachments/media/publication-financial-reports/ar2015.pdf (accessed May 8, 2016).

Superbus.com (2016). Information Superbus. Available from: www.superbus.com/en/about-us.htm (accessed May 13, 2016).

van de Velde, D. (2009). Long-distance bus services in Europe: concessions or free market? OECD/ITF Joint Transport Research Centre Discussion Paper.

Wang, J., & Jin, F. (2007). China’s air passenger transport: an analysis of recent trends. Eurasian Geography and Economics, 48(4), 469–480, doi: 10.2747/1538-7216.48.4.469.

White, P. (2010). The conflict between competition policy and the wider role of the local bus industry in Britain. Research in Transportation Economics, 29(1), 152–158. Available from: http://org/10.1016/j.retrec.2010.07.020

White, P., & Robbins, D. (2012). Long-term development of express coach services in Britain. Research in Transportation Economics, 36(1), 30–38. Available from: http://org/10.1016/j.retrec.2012.03.012

Yin, R. (2003), Case Study Research: Design and Methods, Sage Publications, CA.

Zuidberg, J. (2017). Exploring the determinants for airport profitability: traffic characteristics, low-cost carriers, seasonality and cost efficiency. Transportation Research Part A: Policy and Practice, 101(July), 61–72. Available from: http://org/10.1016/j.tra.2017.04.016

Further reading

Dargay, J., & Clark, S. (2012). The determinants of long distance travel in Great Britain. Transportation Research Part A: Policy and Practice, 46(3), 576–587. Available from: http://org/10.1016/j.tra.2011.11.016