Abstract:

Abstract Purpose The purpose of this paper is to analyze the influence of the technological segment of the general environment in crowdfunding platforms’ operations in Brazil. Design/methodology/approach By means of a qualitative and exploratory approach, the research comprised the execution of a panel of experts via semi-structured interview scripts. For the data analysis, a content analysis with the software NVivo 9 was conducted. Findings One of the main results concerning this influence in the industry would be the expansion of internet access as key factor to scalability of operations and the use of analytics for developing markets. In addition, the cultural aspect emerges as facilitator for platforms access, thus the influence of technological segment cannot be analyzed without considering the cultural segment of the general environment. Research limitations/implications Research limitations relate to the qualitative approach; although valuable insights were obtained for strategic policy in crowdfunding platforms, generalization is not possible. Moreover, the limited number of experts in the panel who agreed to participate may have been an obstacle for richer results. Practical implications Among some implications to the strategic management of crowdfunding platforms in the country are investment prioritization in analytics, governance and transparency of operations and marketing. Analytics will enable more effective insertion in supporting communities and better selection strategies of projects with attributes of success; governance and marketing will aid platforms to reduce cultural resistance on the part of the potential users. Social implications Regulations regarding crowdfunding platforms as well as socio-cultural segment of the strategic environment are key aspects in fostering co-creation among participants and in bringing scale to crowdfunding operations; they may be mediated by technology. Thus, analytics along with marketing initiatives related to addressing shared practices in communities will have a significant impact on the adoption of crowdfunding. Furthermore, such task should be more intense than in developed economies where internet infrastructure and quality access are widespread. Originality/value Although various contributions have been made to the theme of crowdfunding, there has not been identified any paper addressing future influences of the strategic general environment, such as the technological segment, to the operations of crowdfunding platforms, especially in the Brazilian context.

Keywords:· Strategic management · Sharing economy.

Technology environment and crowdfunding platforms in Brazil

Universidade de São Paulo

From the birth of an idea to the generation of a new business, regardless of what area it is (medicine, psychology, math or arts) until its roll-out, obtaining financial resources proves to be a strong obstacle to be overcome (Greco, 2012). Projects with relevant objectives often do not materialize because they do not meet the requirements of traditional financial institutions operating in the market.

The financial market has many institutions that deal with intermediation among these economic agents, such as commercial banks, credit rights investment funds (FIDCs), securitizers and credit unions (Assaf Neto & Lima, 2014; Banco Central do Brasil, 2018; Fortuna, 2015). However, all these financial institutions require a standard for documentary formalization and proof of economic capacity, a fact that inhibits several entrepreneurial initiatives precisely because they are not prepared for such requirements (Greco, 2012). Some examples of these requirements are: the payment capacity (for legal entities), in which the borrowers’ cash flows as well as their equity are evaluated; in some cases, balance sheets are also requested in order to prove the cash liquidity that will enable them to honor the payment of the installments of the requested financing; social and additive contracts (for legal entities), which serve to certify the time of incorporation of the company, as well as its corporate constitution, in order to understand the behavior of the company and its partners in the market; and proof of income (for individuals), which must be duly linked to an employer linked to the Ministry of Labor, or via Income Tax, which assesses the net income that the proponent receives in their income statement.

In this context, crowdfunding emerges as a less bureaucratic and possibly more accessible alternative by adopting a shared model for providing credit to projects. The term comes from the English language and literally means “funding from a crowd,” having adopted as standard the “crowdfunding” term. Its operation is based on multi-person fundraising for a common goal. Today it has the reinforcement of digital tools to give it more dynamism and organization.

It can be said that its beginning was in 2005, reaching scale in 2009, with the launch of the Kickstarter platform in the USA, from which the term crowdfunding was more widespread. In Brazil, crowdfunding was triggered in 2011 from the pioneering platforms Catarse, Queremos!, Benfeitoria and SciBite. Crowdfunding occurs when several people identify with a project and decide to make financial contributions to support it through some incentive.

The growth of crowdfunding in the world is expressive; in 2014, the crowdfunding market grew by 167 percent, representing an increase of $16.2bn. In 2013, the World Bank projected that the segment could move up to $96bn by 2025 (infoDev, 2013). Such data denote the representativeness of future scenarios for the growth of this practice.

By seeking to identify and understand the specific factors that may influence the operations of these projects, this paper presents the following research questions:

RQ1.

What are the main influences of the external environment to the functioning of crowdfunding platforms in Brazil?

RQ2.

How can these influences be characterized?

Thus, the research objective is to analyze the influence of the technological segment of the general environment on crowdfunding platform operations in Brazil.

This work can be justified by the gap in studies that focus on platform management, especially the analysis of the strategic environment. Business environment monitoring is an alternative that enables decision makers to use data and information to better understand the external elements and interconnections of various sectors, translating this understanding into the required planning and decision-making processes. Even if timidly, the results achieved here serve as a focus of attention to the main factors that may be responsible for relevant changes in the actions of crowdfunding platforms.

The practice of collaboration has always existed in society, however, only in recent years there have been more discussions about the so-called collaborative economy, of which crowdfunding is part. This is because digital platforms and other large-scale mediation technologies are recent, although societal collaboration goes back to the beginning of civilization (Sutherland & Jarrahi, 2018). The literature about the main concepts and the theories necessary to understand this research are presented in this section, specifically about the functioning of crowdfunding platforms and the influence of external environment aspects, especially the technological segment, on organizations.

The study on crowdfunding should focus on understanding the crowdsourcing practice, because it has given it the fundamental operation principles: collaboration and the use of technology to give more dynamism to the process. The word crowdsourcing was first registered in June, 2006 in the WIRED technology magazine, where Howe (2006) analyzed companies outsourcing tasks and solving problems to a greater number of people in order to accelerate results considering multiple answers obtained at a much lower cost.

According to Aguiar (2016), crowdsourcing is defined as:

[…] a type of participatory online activity, in which individuals, institutions, non-governmental organizations or companies propose a voluntary commitment to the accomplishment of a task to a group of diverse, heterogeneous and knowledgeable people, through an open and flexible call. Accomplishing the task, which has a variable complexity, in which the crowd must participate by bringing their work, money, knowledge and/or experience, always implies mutual benefit. The user will receive the satisfaction of their need, which may be economic, social recognition, self-esteem or the development of individual skills, while the crowdsourcer will obtain and use to their advantage what the users brought to the enterprise, which will depend on the type of activity requested.

This activity generates platform-operated businesses that are identified as crowdsourcing.

The uses of crowdsourcing are diverse; new models and categories are developed and others fall into disuse over time. Crowdsourcing has become a kind of umbrella term for other terms (Monteiro, 2014). Thus, the use of crowdsourcing paved the way for the first steps of crowdfunding with the technology base that is used today and with its concept of collaboration to achieve a common goal. The actors that make up the crowdfunding market are:

· The crowdsourcer, agent or institution providing the crowdfunding platform. The platform is the virtual space where projects are exposed and transactions are made between proponents and supporters. In this space, the registrations of basic data of agents are also made. The platforms record all the information necessary to follow up on each project.

· The crowd from which a portion of its users become consumers or supporters of crowdfunding project products and services (and also producers, as they financially support and publicize the project on their social networks, mobilizing other users and, therefore, generating new support). The supporter is anyone, either individuals or legal entities, who makes cash donations for any projects that are convenient for them.

· The proponents or entrepreneurs are the creators and responsible for the project; there is no need for a specific qualification for a person to be a proponent, however, the more information is disclosed about the qualities of the project and the proponent(s), the greater is the likelihood of success in the funding.

There are currently four categories of crowdfunding practiced on the world market, according to Belleflamme and Lambert (2014):

1. Donation (crowdfunding without a reward): modality in which the donor, after making their donation, receives nothing in return, except the satisfaction of having contributed to a project that they identified with. This modality generally applies to social and humanitarian projects. Its main front is philanthropy, thus requiring no financial return.

2. Reward (crowdfunding with a reward): this is the most commonly found modality. It is characterized by the supporter receiving a reward in return for their donation. It is based on rewards, and such a model allows the supporting agent to receive something in return, such as a small award or even his or her own name associated with the project receiving the donation. This reward is stipulated by the proponent upon registration of the project on the crowdfunding platform.

3. Equity crowdfunding: in this category, the investment is made directly in the company’s share capital, and the proponent aims to receive dividends on their invested amount. It refers to financing for micro and small companies through the use of stocks (equity based).

4. Debt crowdfunding: based on small loans (lending based), this modality allows supporters to get their money back plus interest; the donor assumes the position of creditor. Such classification is also called peer-to-peer. The supporter contributes with values in a project to which they seek return, they agree on a period for the return and stipulate the rate they expect to receive.

Still regarding remuneration, it is worth mentioning the remuneration of the platform itself, which may vary according to the modality of the projects: “all or nothing” (modality in which the project will only receive the amount collected if it is equal to or higher than the amount requested at the time of registration and within the previously defined and informed period) or flexible (modality in which the project will receive the amounts collected regardless of whether or not it achieved the amount requested at the beginning within the specified period). Some platforms charge different fees for both modalities and others do not make a difference or do not charge at all. However, in all cases, the proponents do not have to pay any amount to register their projects, and the platforms only get their administrative fee if the goal established in the project registration act is met.

The growth of crowdfunding as a collective means for obtaining funding has been fundamental for leveraging new companies (startups), financing electoral campaigns, helping large corporations to demonstrate their products to the market, among other actions (Mollick, 2014; Hemer, 2011; Belleflamme, Lambert, & Schwienbacher, 2010). In Brazil, the most commonly used crowdfunding model is the reward-based model (Monteiro, 2014).

Enabling crowdsourcing and crowdfunding, however, has only been possible through the so-called digital platforms. The literature on platforms presents different perspectives and, from the perspective of the industrial economy, which is adopted in this research, a platform is defined as plurilateral markets, having as its main research interest from such perspective to explore how transactions are mediated within and between groups of economic actors (Gawer, 2014; Breidbach & Brodie, 2017).

Despite the broad consensus around the importance of platforms, a comprehensive definition is far from being built amid different emphases. Breidbach and Brodie (2017) provide as examples of these emphases the so-called co-production environments, in which individuals contribute to the design of physical goods, and shared consumption environments, which provide experiences to their users; there is also the emphasis on transparency, where interactions between actors on one platform must be visible to others, the emphasis on access, whereby actors can integrate their own resources with the platform, the emphasis on dialogue, where there is a direct communication between the different actors, and the emphasis on reflexivity, whose main premise is the platform’s adaptations to change. It is also worth mentioning the argument that ignores the exclusivity of technology-mediated engagement platforms, still considering their possibility within a physical reality.

A crowdfunding platform, however, has its operation completely online; even if someone builds their project outside the internet, they should format it within a platform that works in the internet environment, because all the access by the supporters to collect information and input values will be done through the platform. For projects to be more successful in their dissemination, all platforms use social networks to gain dissemination scale. In this sense, the success or competitiveness of a platform is closely related to the network effects, which affect pricing strategies. These effects influence the propensity of actors to adopt the platform, thus contributing to its competitiveness. Thus, the competitiveness of a platform can only be increased through pricing strategies aiming to subsidize the market side; revenues, on the other hand, are only generated via complementary offers (Breidbach & Brodie, 2017). In addition, engagement by network participants plays a central role in platforms where value is not simply offered by an organization but co-created; this is because the processes of value co-creation among interdependent actors are influenced by shared practices, which generate differentiated engagement practices, intensities and regularities over time. In addition, there is the social context and reciprocal role of shared practices to be considered (Doorn et al., 2010; Storbacka, Brodie, Böhmann, Maglio, & Nenonen, 2016; Breidbach & Brodie, 2017). According to Hui, Gerber, and Greenberg (2012), other services are also provided by platforms such as: legal support and involvement in contract formatting; campaign period and content analysis; the use of deposit accounts and payment method management; pages dedicated to a specific project; project analysis and monitoring; and tutorials before and during the campaign.

Based on the understanding of how a crowdfunding platform works, it is possible to analyze its potential for financing cultural, philanthropic, new businesses, etc. However, in parallel with understanding its potential, it is relevant to understand the environmental influences, that is, the general business environment on the platforms of this sector.

By understanding the platforms as complex and dynamic companies, as well as the need for continuous improvement in their business model through occasional or structural changes, the theme of general environment analysis in the context of strategic management seems appropriate to study them.

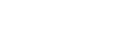

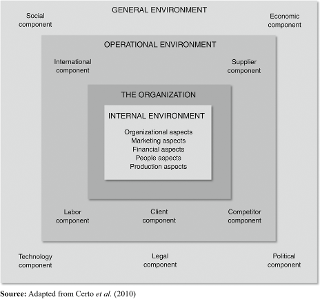

The general environment, in the field of strategic management, corresponds to the external forces that influence the organization and its pursuit of sustainable competitive advantage (the continuous pursuit of above-average sector profits) and its growth, and on which management does not have a power of influence (Certo, Peter, Marcondes, & Cesar, 2010; Hitt, Ireland, & Hoskisson, 2003). Certo, Peter, Marcondes, and Cesar (2010) divide the environment into external environment or macro environment (general environment and operating environment) and internal environment or microenvironment (organization), and their constituent elements as illustrated by Figure 1.

Hitt, Ireland, and Hoskisson (2003) warn that the knowledge about these external forces and their potential impact on the organization can support more assertive and more agile actions and responses. The authors divide the general environment into six segments and some corresponding elements:

1. demographic segment: population size, age structure, geographical distribution, ethnicity distribution, income distribution, etc.;

2. economic segment: inflation rates, interest rates, trade deficit or surplus, budget deficit or surplus (primary), gross domestic product, etc.;

3. political-legal segment: anti-competitive laws, tax laws, deregulation, labor laws, educational policies, etc.;

4. socio-cultural segment: female workforce, diversity, attitudes on quality of life at work, attitudes on the environment, changes in career preferences, etc.;

5. technology segment: product innovations, knowledge applications, focus of private and public research and development (R&D) spending, new communication technologies, etc.; and

6. global segment: important political events, critical global markets, new industrialized economies, distinct cultural and institutional attributes, etc.

In general, the purpose of environmental analysis is to assess the organizational environment so that management can respond appropriately, thus aiming at organizational success (Certo et al., 2010). Hitt et al. (2003) formalize the essential tasks for environmental analysis in an organization in the following:

· reading/scanning: identification of early signs of changes or alterations in the environment and trends;

· monitoring: detection of meanings through continuous observation of changes and trends in the environment;

· forecast: development of anticipated earnings projections based on monitored changes and trends; and

· measurement/assessment: determination of the timing and impact or relevance of environmental changes for the company strategies and management.

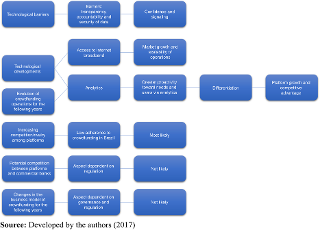

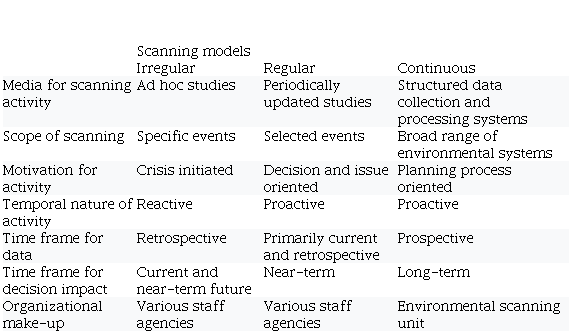

By using the segments or components of the external environment suggested by Certo et al. (2010) and Hitt et al. (2003) and by applying the tasks of reading, monitoring, forecasting and assessing, it is also possible to classify the periodicity with which these activities can be performed and how they themselves may vary. An earlier contribution is provided by Vasconcellos Filho (1979). For the author, environmental segments or components can be classified as opportunities or threats, however, he highlights the fact that this polarization is “insufficient” and even “detrimental to the effectiveness of an environmental analysis”; thus, he suggests a method of classifying these components of the external environment into eight categories: negative (4) (threat, restriction, problem and negative symptom), neutral (1) and positive (3) (positive symptom, incentive and opportunity). In addition, Vasconcellos Filho (1979), based on Fahey and King (1977), suggests different models in examining environmental variables and comparing them to regularity aspects, as shown in Table I.

The analysis of the external environment can take a very broad dimension. Thus, a specific selection of the main components or segments of the general environment is required, as well as the definition of how the reading, monitoring, forecasting and evaluation tasks should be performed. In view of the periodicity of these tasks and the need/urgency of the information to be obtained, a satisfactory environmental analysis will be provided for strategic decision making.

Technology segment analysis in strategic management aims to identify and estimate the impact of changes in technologies and processes occurring in the external environment that may be used by the company or its competitors; however, there is a growing need to understand how seemingly distant technologies can alter the competitive structure of related industries.

Overall, research in collaborative economics is still recent and scattered, involving a number of research areas. In addition, there have been a rapid and growing number of publications since 2008, but most of the literature is highlighted after 2013 and reinforces the notion that technology is a critical element in shared economy (Sutherland & Jarrahi, 2018).

According to Hitt et al. (2003), the technology segment includes product innovations, knowledge applications, private and public R&D priorities, new communication technologies, as well as institutions and activities involved in the creation of new knowledge and the translation of this knowledge into new outputs, products, processes and materials. The reason for a careful analysis of this segment is a better foundation for strategic investment decisions and for changes in the organization; still considering the pioneering condition in adopting new technologies, organizations are generally more likely to gain greater market share and achieve higher returns. Thus, the search for substitute (potential) technologies, as well as new emerging technologies that can contribute to the search for competitive advantage, becomes fundamental (Hitt et al., 2003).

When there is uncertainty about technology, the skills or abilities present in the company may become limited, given the resulting imbalance between the resource needs (to available projects and organizational resources) and the capabilities; such disjunction leads to increased costs and difficulties in the process of information gathering, analysis and integration among decision makers. Therefore, many companies tend to respond to technological uncertainties by adopting or basing their business model on technologies that do not necessarily reflect customer needs but seek superiority over competitors (Atuahene-Gima & Li, 2004). In this context, Xie and Gao (2018), for example, point to a strong relationship between strategic networks – possibly mitigating uncertainty – and the performance of new products developed within the company, as well as ambidextrous innovation – which is both incremental and radical. It is also noteworthy that far beyond technology, innovation on the part of the company – and consequent changes in the structure of the industry – is the result of a choice of business model that takes into consideration decisions about the portfolio of assets and skills to be acquired or to be developed internally (Teece, 2007).

According to Sutherland and Jarrahi (2018), technology-oriented perspectives, particularly the socio-technical perspective, are still rare in collaborative economics research; the economic and social aspects of shared economy common to this particular approach have not been satisfactorily combined or integrated. There is a predominance of approaches that are more focused on business model and the computer science literature that is focused on applications and platforms as optimization tools. Technology segment analysis allows a mapping of technology developments directly or indirectly related to the industry under analysis, as well as their impact in terms of relevant changes in the industrial structure; with this, it is possible to estimate the technological impact to the competitive advantage of industry participants.

This is an applied research, with a qualitative approach and exploratory, based on objectives (Gil, 2008). According to Aaker, Kumar, and Day (1995), this research profile, due to its flexibility, creativity and informality given to the researcher, provides a greater knowledge about a theme and can capture implicit prerogatives; it also encourages subjects (respondents) to think freely about a theme, object or concept. It gives rise to subjective aspects and spontaneously reaches non-explicit motivations, since it does not intend to generalize information. Thus, in this modality, it is possible to work with a smaller group of subjects (Gil, 2008), a choice that is justified here, in the absence of related research studies on the particular theme, because of the need to privilege the comprehensiveness of different views on the subject, rather than a statistically representative sample. Moreover, in view of the intention to understand a specific future condition of a sector and the number of participating experts with relevant knowledge on the subject, such an approach proved to be the most appropriate one.

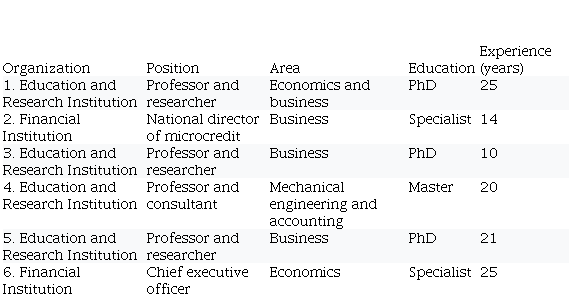

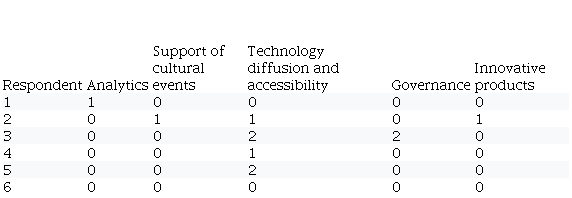

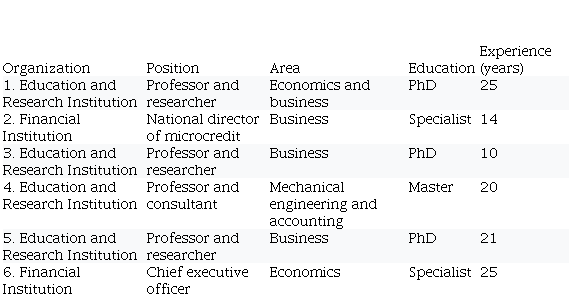

For data collection, carried out between January and August 2017, we used a semi-structured script to conduct a panel with experts. The selection of experts took into consideration professional referrals and a prior survey on the Lattes Platform and the LinkedIn social network. Initially, 22 experts were selected for the panel composition. From them, considering the availability to participate in the research, six experts effectively participated in the panel (Table II). Although none of the selected experts has specific IT background, all of them said they had sufficient knowledge on the subject and the key strategic aspects of the technology involved in crowdfunding operations and covered in the interview script. The confirmation by the experts came after knowing the content of the interview script, sent along with the invitation by e-mail.

Still on the respondents, Pinheiro, Farias, and Abe-Lima (2013) highlight that:

[…] their participation (experts) in the research is not confirmatory (“final word”), they should be considered as one more group of participants that will contribute to compose the set of results to be integrated with each other. In other words, the meaning of the word expert here is somewhat different from its traditional usage; we are listing under this label the people, who having some form of contact with the situation of interest of the investigation (either because they know the people involved or the environmental conditions studied), deserve to be heard, precisely because of their “specialty”.

For the analysis of the reports (qualitative data), we employed a content analysis, research technique whose methodological characteristics are objectivity, systematization and inference. According to Bardin (1979, p. 48):

Content analysis represents a set of communication analysis techniques that aim to obtain, by systematic and objective procedures for describing message content, indicators (either quantitative or not) that allow the inference of knowledge regarding the conditions of production and reception of these messages.

According to Minayo (2007), operationally, content analysis begins by reading the speeches, carried out through interviews, statements and documents transcripts. Generally, all procedures lead to relate semantic structures (significants) with sociological structures (meanings) of utterances and articulate the surface of the utterances of the texts with the factors that determine their characteristics: psychosocial variables, cultural context and message production processes. This analytical set aims to give internal consistency to operations. Thus, for the operationalization of the research, the NVivo 9 software was used with its coding and text storage tools in specific categories. The coding employed was open.

To specifically address the technological segment of the general environment, we used the following script (interview script – influence of the technology segment on crowdfunding platforms in Brazil) based on the authors Certo et al. (2010) and Hitt et al. (2003) and industry characteristics.

Interview script: influence of the technology segment of the external environment on crowdfunding platforms in Brazil:

1. Despite the wide availability of technologies that enable crowdfunding operations, are there technological barriers that hinder its further development and expansion? Which ones? Please comment.

2. What are the main technological developments that may increase the reach of crowdfunding operations over the next few years? Please list and comment on at least two of the main developments.

3. With the wide availability of technologies that enable crowdfunding operations, it can be said that there will be a fierce competition between platforms for funds in the coming years? Please comment.

4. With the wide availability of technologies that enable crowdfunding platforms operations are likely to compete with traditional banking institutions in the coming years? Please comment.

5. From a technological development standpoint, how to you foresee crowdfunding operations in the next few years?

6. What facts about technology may trigger profound changes in the business model of crowdfunding in coming years? Please comment.

The following section presents the main results obtained from the content analysis of the reports obtained from the experts.

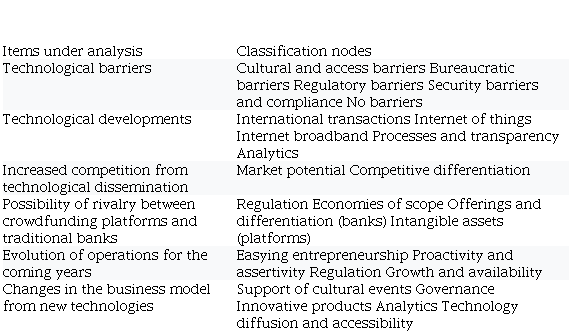

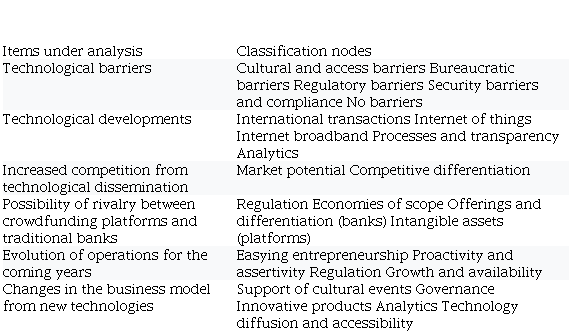

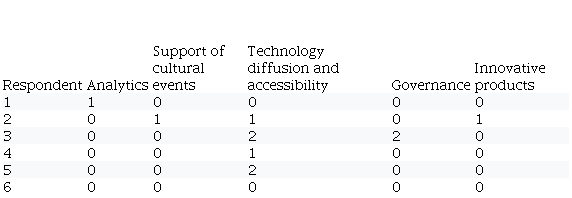

The six aspects analyzed within the domain of the technology segment and their influence on crowdfunding platforms in Brazil were: technological barriers, technological developments, increased competition from technological dissemination, possibility of rivalry between crowdfunding platforms and traditional banks, evolution of operations for the coming years and changes in the business model from new technologies. Initially, based on a previous reading, the classification nodes of the contents provided by the reports were defined and then refined according to Table III.

Then, an analysis of the codings for each of the six items was performed. Coding can be understood as the “process by which raw data is systematically transformed into categories that afterwards allow a precise discussion on the relevant content characteristics” (Campos, 2004).

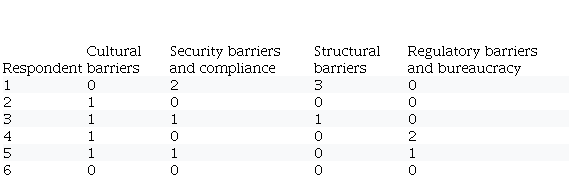

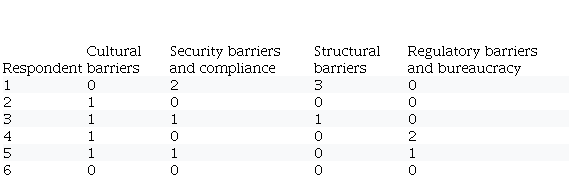

Regarding the first item, that is, technological barriers, most of the codings were highlighted around cultural barriers (four codings) (although not pertinent to the technological domain), security and compliance barriers and structural barriers (four codings, respectively) and regulatory and bureaucracy barriers (three codings) (Table IV).

In summary, nodes highlight the issue of transparency and accountability, as well as the security of data provided by supporters; control and accountability, as well as transparency, can increase the degree of confidence of project supporters, especially by considering software and systems that allow for real-time monitoring of project developments. In this sense, reputation through certification can help resolve this barrier. Structural barriers refer mainly to access to broadband by populations outside urban centers and even in remote regions; as internet access is expanded, according to one of the respondents, we can expect an increase in the projects and funds raised by the platforms. Regarding cultural barriers, although not essentially technological, they were mentioned in four codings; there are still restrictions on the access and, mainly, the familiarity of the platforms by a large part of the population in the country. As broadband expansion occurs, it can be said that this familiarization with the platforms can occur, but also depending on considerable investments in marketing. Regulatory barriers and bureaucracy, in turn, are represented by the supporters’ distrust of having to provide specific personal data, the difficulties in meeting the demands of non-governmental organizations and impeding the rapid and efficient transfer of resources between countries. It should be noted in this scope that the guiding regulations in Brazil are directly related to avoiding the practice of money laundering. However, bureaucracy and regulation undermine the dynamics as well as the potential growth of the platforms.

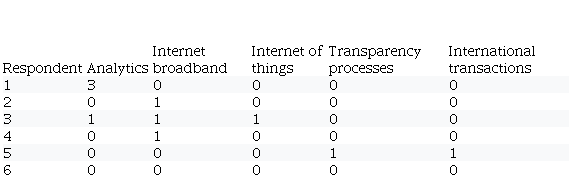

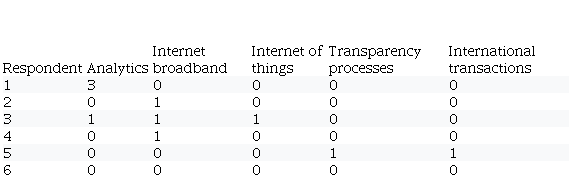

Regarding new technological developments, the main categories (nodes) mentioned were: analytics, broadband, Internet of Things, process and transparency and international transactions (Table V).

Two categories stand out: analytics and broadband. Analytics, particularly regarding the possibilities that data analysis can bring to identify the potential of new projects based on their success attributes, as well as identifying and working with communities such as market segments that have the potential to generate new projects and get funding. All analytics-related codings express this tool’s direct relationship to the growth and development of crowdfunding platforms. In turn, broadband is related to internet access that many segments of the population do not yet have. As with the first item, expanding quality internet access can contribute to scale gains in crowdfunding operations. It is worth mentioning technologies that can increase transparency regarding project management, especially through technologies such as the Internet of Things.

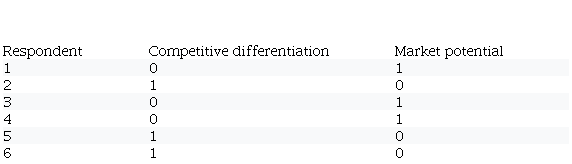

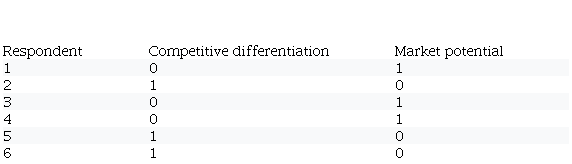

Regarding a possible increase in competition or rivalry between platforms from the spread of technologies, all respondents mention the upward trend. This increase, however, relates to two categories: market potential and competitive strategies, especially differentiation (Table VI).

Market potential refers specifically to increasing competition or rivalry among supporter communities likely to invest in projects; despite the growth, economies of scale still depend on wider diffusion of crowdfunding. In addition, various crowdfunding modalities are still being defined and becoming familiar to the population. Over time and with the consolidation of these options, market potential will tend to increase. From these considerations, rivalry will tend to increase at a faster rate than market potential, not only for supporter communities, but also for skilled human resources. As for competitive differentiation, there is room for relativizing this rivalry: differentiation is above all related to the rewards and attractiveness, even if not financial, of projects; besides that, differentiation will allow different platforms to coexist, each one with its competitive strategy; otherwise, there will be consolidation over time of few platforms, because many of them will cease to exist. With this, the variable rivalry becomes not so determinant.

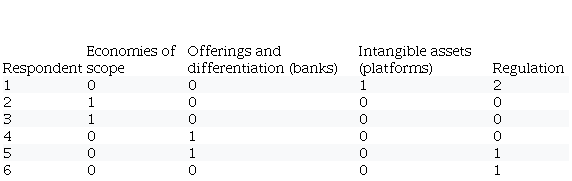

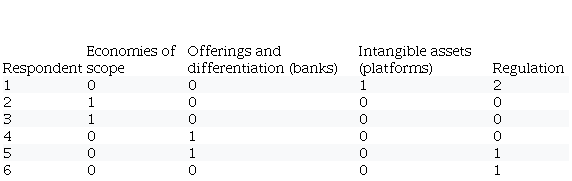

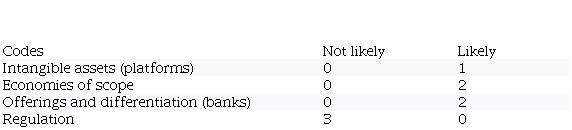

Competition between platforms and traditional banks, though a possibility, has yielded diverging answers. Depending on the platforms’ ability to develop governance, brand and trust, they may have limited impact on some banking products and services. At the same time, banking institutions also stand as strong rivals by partnering or developing fintechs, companies or technology platforms in the financial sector. In addition, taking advantage of its brand advantage and economic strength, banks are already operating with venture capital. Thus, banks have great advantage from scope economies to develop new business models and explore new segments, or even the capital required for platform acquisitions (Table VII).

The main point about this possible rivalry, however, lies in the regulatory aspect: expanding platform space will inevitably bump into existing banking regulations; the argument about entrepreneurship and the ease of investing in social projects will not be taken into account in the regulation of platforms either, but the crimes potentially committed against the financial system, so regulation will imply unlikely rivalry or at least slight rivalry (Table VIII). However, the cultural aspect, especially people’s knowledge and trust regarding platforms, is still the big factor that keeps this rivalry as a remote possibility.

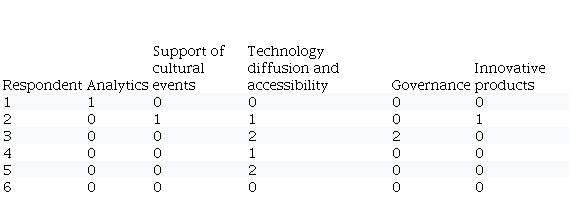

Regarding the evolution of platform operations based on technological developments (Table IX), similarly to the previous item, there was a strong emphasis on regulatory aspects, despite available technologies and growth and availability with broadband access. However, the effect that platforms will promote on entrepreneurship stands out and, given the challenges already explained, they should be more proactive and assertive in relation to the needs of their users. An example would be the combination of products and services, which is a strategy possible through analytics.

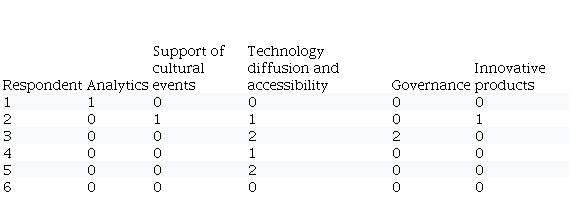

The last analysis item, that is, the changes in the business model based on new technologies (Table X), in addition to highlighting the scalability aspect of operations through people’s broadband accessibility and the spread of equipment such as smartphones, contemplates governance as an essential variable for the operationalization of the platforms, as well as the possibility of offering new products and services and the possibility of crowdfunding becoming a major funder of the cultural industry as an alternative to centralizing Federal Government resources.

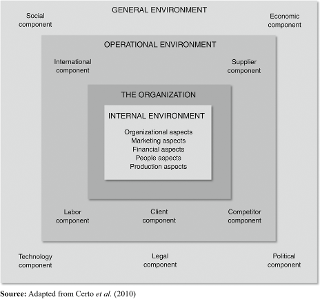

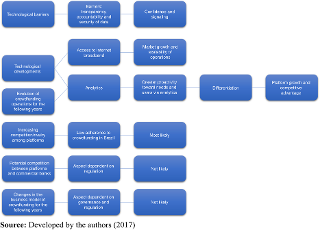

In general, it can be said that the cultural aspect has a much greater influence than the technological segment, although the issue of technological diffusion, characterized primarily by low broadband access, is still a very relevant technological barrier for platform operations. In almost all items, both the cultural and regulatory aspects were evident; even so, in relation to technology, great possibilities are evident from the data analysis tools. The main findings of the research can be summarized in Figure 2.

From these analyses, comments and final considerations of the research are presented below.

This paper aimed to analyze the influence of technology as a segment of the general environment on crowdfunding platform operations in Brazil. To conduct the research, a panel with six specialists was conducted, whose reports were analyzed through a content analysis with the aid of specific software. From the six items analyzed within the technology segment, the following conclusions could be drawn.

First, population broadband access, which is a barrier to platform growth and expansion, is essential for scaling operations; moreover, this aspect is directly related to the socio-cultural segment of the general environment, that is, people’s trust and greater acceptance of crowdfunding. Thus, this technological aspect cannot be dissociated from other cultural aspects, which implies considerable marketing investments by the platforms. This conclusion is in line with the considerations of van Doorn et al. (2010), Storbacka, Brodie, Böhmann, Maglio, and Nenonen (2016) and Breidbach and Brodie (2017) on the need to promote engagement among potential users, while exploring the social context through which the sharing of practices manifests itself.

Second, the use of data analysis is a strong trend not only for the improvement of projects that may have impact, but also for the development of the supporter communities themselves, still constrained by market distrust; in this scope, once again the considerations of van Doorn et al. (2010), Storbacka et al. (2016) and Breidbach and Brodie (2017) on the understanding of the engagement process and the dynamics among actors responsible for the co-creation of value are pertinent. Analytics must also go hand-in-hand with new governance and transparency processes on these platforms. This joint strategy can garner new fans and thus expand the user base. Given the tight market for a few years yet, there is a growing rivalry among platforms, particularly in talent acquisition; but the data analysis necessary to improve rewards and to enter communities with specific needs can soften such a movement. Still, because there are no exit barriers, many platforms may close or be acquired by others.

Finally, both financial market regulation and bureaucratic structure can undermine the expansion of platform operations. Added to this is the need for specific information from project supporters, a natural phenomenon in contexts of information asymmetry; barriers to international transactions can also impede such development, as well as regulation that favors efforts to prevent crimes against the financial system rather than efforts to foster entrepreneurship or social projects. Therefore, it is worth highlighting the importance of the political-legal segment, despite technological developments, for the expansion and competitiveness of crowdfunding platforms.

As a contribution to platforms, this study warns of the importance of using technologies (analytics and marketing) to explore the dynamics of co-creation among crowdfunding platform users (Breidbach & Brodie, 2017); it also sheds light on the importance of scaling operations from other strategic environment analysis segments (besides broadband/internet access): political-legal and socio-cultural, on which they are mediated by technology. Thus, investments and actions of technology platforms should be accompanied by considerations about the other two mentioned segments. Finally, this study warns of a possible rise in platform rivalry as a result of the slow rate of expansion of the potential market compared to technological development.

In response to Sutherland and Jarrahi’s (2018) call for more research addressing the technological perspective and social and economic transformations in shared economy platforms, this research sought to explore the main transformations in the sectoral structure of crowdfunding platforms in Brazil from technology. Despite this contribution, especially with regard to originality, it has some limitations: even if there is no need to comply with statistical sampling requirements, the number of panelists can be increased and the reports can be enriched. In addition, the study addressed only one segment of the general environment, the technology segment. It is known that the influence of others is important for an effective analysis, thus, it is suggested that other studies have a more complete approach by using structured questionnaires.

Figure 1

Elements of the organizational environment

Adapted from Certo et al. (2010)

Figure 2

Synthesis of the analytical factors and their relations evidenced in the results

Developed by the authors (2017)

Scanning model framework

Fahey and King (1977) and Vasconcellos Filho (1979)

Experts’ profile

Prepared by the authors (2017)

Items under analysis and classification nodes derived from interview registries

Research data (2017)

Technological barriers – codes

Research data (2017)

New technological developments – codes

Research data (2017)

Increase in competition from technology dissemination – codes

Research data (2017)

Rivalry between platforms and traditional banks – codes

Research data (2017)

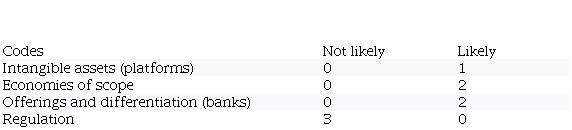

Coding matrix – rivalry between platforms and traditional banks and likelihood

Research data (2017)

Evolution of crowdfunding operations from new technological developments – codes

Research data (2017)

Changes in the crowdfunding business model caused by new technologies – codes

Research data (2017)

Figure 1

Elements of the organizational environment

Adapted from Certo et al. (2010)

Figure 2

Synthesis of the analytical factors and their relations evidenced in the results

Developed by the authors (2017)

Scanning model framework

Fahey and King (1977) and Vasconcellos Filho (1979)

Experts’ profile

Prepared by the authors (2017)

Items under analysis and classification nodes derived from interview registries

Research data (2017)

Technological barriers – codes

Research data (2017)

New technological developments – codes

Research data (2017)

Increase in competition from technology dissemination – codes

Research data (2017)

Rivalry between platforms and traditional banks – codes

Research data (2017)

Coding matrix – rivalry between platforms and traditional banks and likelihood

Research data (2017)

Evolution of crowdfunding operations from new technological developments – codes

Research data (2017)

Changes in the crowdfunding business model caused by new technologies – codes

Research data (2017)