Abstract:

Purpose Considering that the heterogeneity in the composition of deliberation and management bodies can promote a differentiated impact on earnings distribution policies of companies, the purpose of this paper is to examine the marginal influence of female participation on the board of directors and executive board regarding decisions associated with dividend policy in companies operating in Brazil. Design/methodology/approach The sample is composed of non-financial companies listed on the B3 Stock Exchange between 2010 and 2015, which encompasses 261 companies (1,084 observations per year). The tests aim at explaining the probability of earnings distribution and the payout level of companies through variables that measure the female presence – considering that the explanatory economic attributes of decisions over dividends are kept under control. The econometric analysis was carried out through the descriptive analysis of the variables and LOGIT and TOBIT tests of inference estimated with fixed effects and meeting all econometric requirements. Findings The proportion of women in both deliberative and executive bodies affects marginally the dividend policy of Brazilian companies. The female presence in management bodies contributes to a higher probability of earnings distribution and increase in the payout level; such tendency is moderated when women are in the board of directors; so, we do not reject the hypothesis of female influence on dividend policy decisions in Brazil. Originality/value One can find such investigations in foreign environments, but such tests had not been accomplished in Brazil so far. We discuss, therefore, in an unprecedented way, the heterogeneity in deliberative (governance) and executive (management) bodies and its outcomes in strategic decisions made in Brazilian companies, focusing on the female insertion and on fundamental decisions that are related to the relationship among stakeholders, which is the dividend policy per se.

Keywords: Heterogeneity and gender, Governance and management, Dividend policy.

Gender diversity, governance and dividend policy in Brazil

Universidade de São Paulo

The growth of the presence of women in the management of organizations, which makes the composition of deliberative bodies more heterogenous – most importantly regarding gender – indicates notorious sources of different perspectives and solutions for strategic decisions in companies. Thimóteo, Zampier & Stefano (2015) affirm that, despite the patriarchal culture that exists in Brazil, the market has acknowledged the strength of the female presence in strategic positions and identified that the characteristics of female leadership can be responsible for reshaping the method and content of entrepreneurial decision-making.

Before such complex organizational environments marked by constant changes, one understands that such diversity can alter the content and the quality of decision-making in companies due to the female presence in management as an absent variable in previous scenarios; moreover, evidences have pointed out that heterogenous groups affect the quality of perspectives and judgment in the decision-making process, which shows superior results when compared to decisions made by less diverse groups (Francoeur, Labelle, & Sinclair-Desgagné, 2008).

Byoun, Chang & Kim (2016) affirm that the heterogeneity in the composition of management bodies of a company can promote a positive impact on the mitigation of agency conflicts and gender diversity – more specifically – can work as an arbitrage of conflicting interests, favoring a higher identification among the agents of the organization. Besides, the authors conclude that gender diversity has promoted a greater monitoring of contracts with a consequent effectiveness in the resolution of conflicts between stockholders and managers.

As the heterogeneity of the company's upper management team brings a greater variety of perspectives for entrepreneurial decisions (Byoun et al., 2016), it is possible to notice according to Martínez & Oms (2016) a differentiation in decisions regarding capital allocation in companies due to the female presence. According to these authors, women operating in strategic decisions can still incorporate strong control mechanisms in management. Such statement has also been made by Carter, Simkins & Simpson (2003) when affirming that the female participation in management raised important issues that did not come from directors with a homogenous cultural background, stereotyped by the male gender.

This way, we intend to find out if the female participation in deliberative bodies can reflect aspects of the decision-making process in management, reaching elements explicitly related to dividend policy, which is a theme strongly associated with capital structure and cost regarding potential conflicts between managers, stockholders, debt investors and minority shareholders.

The dividend policy is to be found as one of the main research elements on finances more due to its governance characteristic than to the simple generation of earnings and operational cash flows. When being outlined through managerial issues according to the performance of the company, the dividend policy can also be aligned with personal interests (or behavioral attributes) of managers (Martínez & Oms, 2016); therefore, it can also be influenced by distinct female abilities considering the evidences of marginal influence of heterogeneity in the design of such policies, especially regarding decisions that involve behavioral items.

We argue, therefore, that the female presence can incorporate stronger monitoring mechanisms, which could lead to a break (or modification) of the modus operandi of a determined group, in this case, management and deliberation bodies, on behalf of stakeholders' interests. In this study, we understand that the differentiation would occur through greater and more frequent levels of earnings distribution; such levels would be controlled by the company's economic and financial conditions that are restricted to its liquidity.

The scope of the research focuses on the detection of signals that identify the marginal influence of the female participation, in the board of directors (BD) and in positions of the executive board (EB) in Brazilian companies, on dividend policy-related decisions; we intend to analyze if the increase of female participation per se – apart from any cognitive, institutional or individual attributes – can affect the decision-making in terms of dividend policy.

This way, we intend to investigate and to deepen the analysis on heterogeneity in the composition of management bodies of companies regarding the level and nature of their decisions, represented by deliberations referring to the distribution of dividends, while also comparing such decisions to the ones taken by more homogenous bodies in terms of social and demographic characteristics.

It is worth emphasizing that interactions between female participation in upper management bodies and dividend policy are still in its early stage of discussion in the international scientific scenario (Byoun et al., 2016; Mcguinness, Lam & Vieito, 2015; Martínez & Oms, 2016; Van Pelt, 2013). Furthermore, the justification of this research is related to the provision of contributions to the literature by adding evidences on the consequences of gender diversity in management regarding strategic decisions, which involve contracts between the company and important stakeholders in a developing economic environment and aggregates behavioral and human variables not represented by purely economic models. In the managerial sphere, the results can raise discussions on the use of monitoring mechanisms, helping the decision to implement policies that favor more heterogenous groups within the composition of company bodies.

Besides, we also justify this research by the lack of explanations on dividend policy, taking into account the inconclusiveness of previous research studies; models that try to explain such phenomenon still lacks a more rigorous formalization. We provide, therefore, the academia with knowledge on the theme, and investors with evidences of impacts differentiated by the female presence in the decisions that can affect the return of capital, especially regarding the reception of cash flows in Brazilian companies.

The homogeneity of characteristics of individuals in upper management (such as white, middle-class and middle-aged men) indicates a group of workers with similar educational backgrounds and market experiences (Singh, Vinnicombe & Johnson, 2001). This sort of corporate boards composition implies a limited perspective of managers especially in terms of contractual relationships – which ultimately arises from diverse perspectives on social and political interpersonal relationships – while the diversity of such managerial team could entail a wider spectrum regarding contractual situations and economic agreements (Carter et al., 2003).

Diversity in upper management, according to Byoun et al. (2016), promotes a better understanding of the environmental complexity, reducing risks stemming from a unique way of thinking of a determined group; this way, diversity would be contributing to a more effective decision-making. This has also been perceived by Perryman, Fernando & Tripathy (2016) when mentioning the characteristic value of diverse groups in making decisions in innovation-related situations.

According to Robinson & Dechant (1997) and Byoun et al. (2016), team heterogeneity in management has produced creative and innovative solutions for entrepreneurial problems. This way, it is possible to emphasize that the heterogeneity (or diversity) of the staff that composes the upper management can bring a greater variety of perspectives in entrepreneurial decisions (Byoun et al., 2016; Perryman et al., 2016), which turns problem-solving more effective from a contractual point of view (Robinson & Dechant, 1997).

On the other hand, despite recognizing that a greater diversity among members of the BD can promote creative and innovative ideas, Carter, D'Souza, Simkins & Simpson (2010) indicated that such heterogeneity can also indicate a slower and more conflicting decision-making process.

Thus, the incorporation of heterogenous groups in company management, especially in terms of deliberative aspects, could influence directly strategies established in the decision-making process of the company – considering particular impressions and perceptions of an individual with low participation in the decision-making team of the company. The composition of bodies of strategic decisions regarding gender, race and culture is considered therefore an important issue to be faced by managers, directors and company's shareholders (Carter et al., 2003).

As pointed out by Thimóteo et al. (2015), women have been performing social roles considered predominantly masculine, such as corporate positions and functions. However, the authors highlight that the head of the company and positions of higher social prestige and power – i.e. activities involved with leadership – are activities predominantly linked to the male figure. Such reality is also acknowledged by Gomes (2005) when affirming that organizations were designed based on male values and, therefore, the male presence is predominant and by Gonçalves, Espejo, Altoé and Voese. (2016) when addressing the entrepreneurial universe. According to these researchers, there is a growth in the number of women in companies, but only a few are chosen for deliberative and strategic positions. It is worth mentioning some exceptions stemming from succession processes, most importantly regarding the family control over companies.

A study conducted with 176 companies (Spencer Stuart, 2017) indicates a low female participation in BD; women represented 8.2 percent of the members. According to this report, there was a little representative evolution of gender diversity in the country – Brazil is, therefore, among the countries that present the lowest representativeness of women in this sort of board. Besides, the research still indicates that in only three companies of the sample the CEO is a woman, which represents 1.7 percent of the companies analyzed.

The low female participation in deliberative positions can be explained by the late women entry in the labor market. Gomes (2005) presents the historical evolution of such panorama, according to which in ancient times domestic activities were acknowledged as a prominently female duty. With the emergence of industrial revolution, women started being accepted in the labor market as long as they performed the least important activities with the lowest wages. In the 20th century, the Second World War ended up mobilizing the female workforce in the countries that were directly involved with the war.

Data obtained through the International Labor Organization indicate that in Brazil the active female workforce, as percent of the active population, was 53 percent in 1995 and 60 percent in 2015; the male workforce was represented by 86.6 percent in 1995 and 81.3 percent in 2013. These data show the effects of the late entry of women into the labor market.

The management accomplished by women, on the other hand, can be seen as a differentiated managerial resource, considering that the particular characteristics of the female personality can be better exposed (Thimóteo et al., 2015), such as flexibility, ability to work in a team and to manage diversity, according to Gomes (2005). Moreover, the presence of women in managerial bodies can provide unique resources and relationships, which can become relevant assets to the company (Terjesen, Couto, & Francisco, 2016).

Perspectives on risks and opportunity in organizations can also be realized in different ways in heterogenous groups. With regard to the gender, the literature reveals that common sense assigns the search for risk to the male gender, while the female gender is more associated with higher risk aversion levels and, consequently, a more uncompromising attitude toward new opportunities (Grant Thornton, 2017).

The literature recognizes consequently that gender diversity has been translated into different types of behavior regarding leadership styles (Post, 2015), higher conservatism (Francis, Hasan, Park & Wu, 2015; García-Sánchez, Martínez-Ferrero & García-Meca, 2017) and higher risk aversion (Grant Thornton, 2017; Perryman et al., 2016).

There are some specific studies that focus on different effects stemming from female participation in the deliberative organizational spheres regarding the performance of companies (Adams & Ferreira, 2009; Carter et al., 2010; Perryman et al., 2016; Terjesen et al., 2016); impacts on company's value (Campbell & Vera, 2008, 2010; Carter et al., 2003) and attributes of corporate governance (Adams & Ferreira, 2009; Francoeur et al., 2008).

This way, the female growth has been seen as a factor that can provide a strategic basis for corporate decision-making (Mcguinness et al., 2015), considering the possibility of the creation of unique information that stem from the heterogeneity of the team that composes the upper management (Carter et al., 2010). The possible impact of the female presence in the governance of companies is also acknowledged by Adams & Ferreira (2009) and Singh et al. (2001).

There are more specific consequences related to the female presence in management, such as the adoption of a more conservative attitude regarding the measurement and projection of revenues and a greater impact on corporate governance (Mcguinness et al., 2015); contribution to the mitigation of agency problems (Martínez & Oms, 2016) and increase in the monitoring of administrators (Adams & Ferreira, 2009).

The dividend policy is considered a prominent financial and economic decision for managers, investors and other stakeholders (Martínez & Oms, 2016) considering that the earnings distribution is understood as a relevant mechanism to reduce or mitigate agency costs (Byoun et al., 2016; Van Pelt, 2013). This occurs due to the role played by dividend policy in the modification of investors' expectation because decisions associated with earnings distribution can transmit more accurate information on the expectations of the firm's management regarding the economic situation of the company (Gupta & Aggarwal, 2018); in this case, the behavior toward dividends is seen as an instrument that signals the economic situation and the perspective of the firm in terms of investments.

Understood as the decision of how much and when to pay shareholders, the dividend policy involves deciding if the earnings will be retained by the firm for reinvestment purposes (Gupta & Aggarwal, 2018) or future earnings generation. The dividend policy, therefore, is established by the priority defined temporally by the management team regarding the allocation of earnings generated according to the decisions of strategic allocation of investment (Martínez & Oms, 2016). The essential cost for the definition of the dividend policy will be related to liquidity – both operational and investment – which tends to decrease when the number of paid dividends increases. It indicates that the firm may appeal to third-party capital, which tends to be more expensive (Van Pelt, 2013). The dividend policy can be seen, from this perspective, as a way to a align incentives between managers and shareholders (Martínez & Oms, 2016).

By analyzing strictly costs and benefits, the variables commonly known as determinant factors related to dividend decisions are related to the leverage, growth opportunity and size of the firm.

Gonzaga and Costa (2009) indicate that leverage is a primary indicator of dividend policy and emphasize – in addition to the influence on the levels of future liquidity – the strong relation to agency conflicts. According to Van Pelt (2013), the costs of debt are used by financial institutions as a monitoring mechanism of their relationships because creditors demand cash flows generated by the operations to reimburse the debts and their accessories (Ye, Deng, Liu, Szewczyk & Chen, 2019). Accordingly, greater obligations jeopardize the future cash flow performance, what compromises dividend disbursement (Gonzaga & Costa, 2009); current evidences have indicated a negative relationship between the debt and level of dividend (Rizqia, Aisjah & Sumiati, 2013; Van Pelt, 2013).

Growth opportunities are also mentioned as moderators of dividend policy. Jurkus, Park & Woodard (2011) highlight that agency conflicts related to free cash flows tend to be more present in companies with lower growth possibility because the ones with high growth opportunity justify the low levels of dividends since they use discretionarily free cash flows to fund new investments. This way, it is possible to expect that growth opportunities indicate a tendency toward lower levels of dividends to be paid (Van Pelt, 2013).

Another aspect that can influence the dividend policy is the firm size. Rizqia et al. (2013) state that large companies are more likely to pay dividends; such affirmation is based on the idea that larger companies tend to present lower transaction costs, better access to the capital market and economic stability, which enables them to offer higher dividends when compared to smaller companies. Besides, large companies are more willing to reduce agency conflicts by adopting dividend payment as a way to mitigate them (Ye et al., 2019). There are evidences that indicate a positive relationship between firm size and dividend payment (Rizqia et al., 2013; Martínez & Oms, 2016; Ye et al., 2019).

Other aspects related to institutional or shareholder characteristics were analyzed as factors that can influence the dividend policy, such as the type of shareholder of the company. The dividend policy can be influenced by, for instance, state (Saeed & Sameer, 2017; Ye et al., 2019), institutional (Van Pelt, 2013) or family ownership (Ye et al., 2019). Another aspect related to the ownership structure was also analyzed and showed a significant impact on the decisions regarding earnings distribution.

Ye et al. (2019) indicate that, when there are restrictions to the sale of shares, paying dividends could provide an opportunity for managers to obtain additional paybacks only due to such policy. Otherwise, Rizqia et al. (2013) affirm that managerial ownership can reduce the changes of an opportunistic behavior, which is negatively related to dividend policy. There are, therefore, relevant evidences that establish a relationship between dividend policy and ownership structure.

When considering that dividend distribution in large proportion restricts the performance of managers, taking into account that the smaller portion of the earnings will be available for investment in projects that may not interest the shareholder, the heterogeneity of the bodies in the company's management team may contribute to a higher independency of management.

The existence of heterogeneous bodies enables a breakdown in the way that they operate, which can also decrease agency costs considering that the members of such bodies can work as controlling agents when using mechanisms – in this case, higher distribution of dividends – to reduce agency conflicts. From this perspective, Martínez and Oms (2016) and Byoun et al. (2016) affirm that the female presence in the decision-making process of the firm can have a positive impact on the dividend policy, since women's choices tend to limit the opportunism of managers to the detriment of shareholders' rights.

Martínez and Oms (2016), when analyzing the impact of gender diversity on the BD regarding dividend policy in companies of the Spanish stock market between 2004 and 2012, observed that companies with positive results are more prone to distribute dividends as far as the proportion of women in the BD increases.

Byoun et al. (2016) investigated some characteristics of board members on dividend policy by analyzing the database of COMPUSTAT between 1997 and 2008. The results of the research indicate that gender diversity in firm's BD, which is measured by the proportion of women and by the presence of more than one woman in the management team, leads to significant changes in the dividend policy. Such argument is supported by the idea that the female presence in the composition of the management team contributes to a more effective monitoring of actions accomplished by the BD; consequently, more benefits are conceded to shareholders, considering the greater propensity to pay dividends and higher payout.

However, Van Pelt (2013), when investigating the effect of characteristics of directors on the dividend policy in companies traded in the North American market from 2008 to 2011, rejected the hypothesis that the proportion of women in board positions influences the dividend-related decisions.

Complementarily, Chen, Leung & Goergen (2017) investigating the North American scenario between 1997 to 2011 affirm that gender diversity in the BD increases significantly the payment of dividends only in companies with weak governance. The authors suggest that female directors use the payment of dividends as a governance mechanism.

On the other hand, the results of Mcguinness et al. (2015) and Saeed and Sameer (2017) indicate that there are other aspects inherent to the firm that contribute to dividend-related decisions, not necessarily related to the gender of the governance members of the company.

Mcguinness et al. (2015) investigated the female presence in boards of firms asserting that women are more risk averse and, this way, are more prone to accumulate liquidity and working capital. When examining the association between characteristics of the members of the BD and the dividend policy in the Chinese financial market between 2000 and 2008, the authors suggest that men and women show similar levels of risk aversion in situations of financial decision-making. The authors highlight that other characteristics, such as firms' ownership and firm size, may have masked the influence played by gender on dividend-related decisions.

Saeed and Sameer (2017) when investigating the impact of the female presence in the BD regarding the dividend policy in companies operating in India, China and Russia between 2007 to 2014, affirm that a growing number of women in the board of the firms has a negative impact on the payment of dividends in the companies of the sample. The authors indicate that this phenomenon occurs because these companies are subject to an inefficient regulatory environment, which demands more conservative funding policies.

Based on the conception that gender diversity enables the emergence of differences in managerial performance, one can state that the female presence in management can lead to payment of dividends in a superior level (Byoun et al., 2016; Mcguinness et al., 2015; Martínez & Oms, 2016; Van Pelt, 2013).

Saeed and Sameer (2017) affirm that the inclusion of individuals with different characteristics, backgrounds and experiences in deliberative bodies can indicate that their decisions might be influenced by some factors, including decisions related to dividend distribution. Gender diversity can align the economic incentives of managers and shareholders based on their effects on the dividend policy of companies.

The conception that there are differences between the behaviors related to the female and male genders leads to the conclusion that the female presence in the upper management tends to lead to different courses of action in comparison to the ones accomplished by a homogenous male management. It is possible to argue, therefore, that a higher female participation can lead to an alteration of the modus operandi of the upper management, which could increase the independence of the director council regarding investor groups and would give more room for the incorporation of diverse behaviors not related to standard stereotyped male ones.

As far as research studies in foreign economic environments show evidences that gender diversity contributes to the mitigation of agency costs (Jurkus et al., 2011); to the reduction of managers' opportunistic behavior (Campbell & Vera, 2008, 2010) and to the increase of dividend payment (Martínez & Oms, 2016), we propose the hypothesis that, in the Brazilian scenario, the propension to distribute dividends and the payout level of the earnings distributed will be affected positively by the female participation in the deliberation of strategic managerial bodies.

When focusing on the female presence in corporate management (board of directors and executive board), we establish that there are differences among strategic decisions of the company because of such factor. Among the singularities that the female participation can bring to the entrepreneurial performance and positioning, we highlight – in addition to economic and financial drivers – aspects related to investors, mitigation of agency conflict, emphasizing the gender heterogeneity (i.e. gender diversity) as a mechanism used in order to reduce agency conflicts and informational asymmetries.

It is possible to observe, however, that the effects of female participation on the decisions on the dividend policy can be diverse, considering that the organizational context and the institutional environment can also influence such relationship. On the other hand, considering that the low protection level toward shareholders and investors can guide corporate choices in issues related to dividend policy (Consoni, Colauto & Lima, 2017), and considering that the presence of women creates heterogeneity in the management team altering the decision-making, leads us to establish the hypothesis that the female presence in management positions in Brazilian companies contributes to differentiate decisions on dividend policy in terms of payout levels and propensity to distribute earnings, according to the evidences reported in different – and institutionally more advanced – scenarios.

The research population is composed of non-financial companies listed on the Brazil, Bolsa, Balcão (B3) Stock with data available from 2010 to 2015. This way, the sample of the research presents a census characteristic regarding public-traded companies and was shaped based on the exclusion of observations that provided no access to the data necessary for estimation; loss in the period, which could invert the signal of the information making no economic sense, and therefore, showed negative payout ratios, which is also undesired economically speaking.

After a few adjustments, the final sample was composed of 261 companies with 1,084 observations per year; the data were collected from the database Economática® and from reference forms provided by the B3 website.

The premise that the female participation in upper management bodies alters the dividend policy of firms is investigated through the following aspects: propension to distribute or retain earnings and, if they distribute, the payout level of dividends.

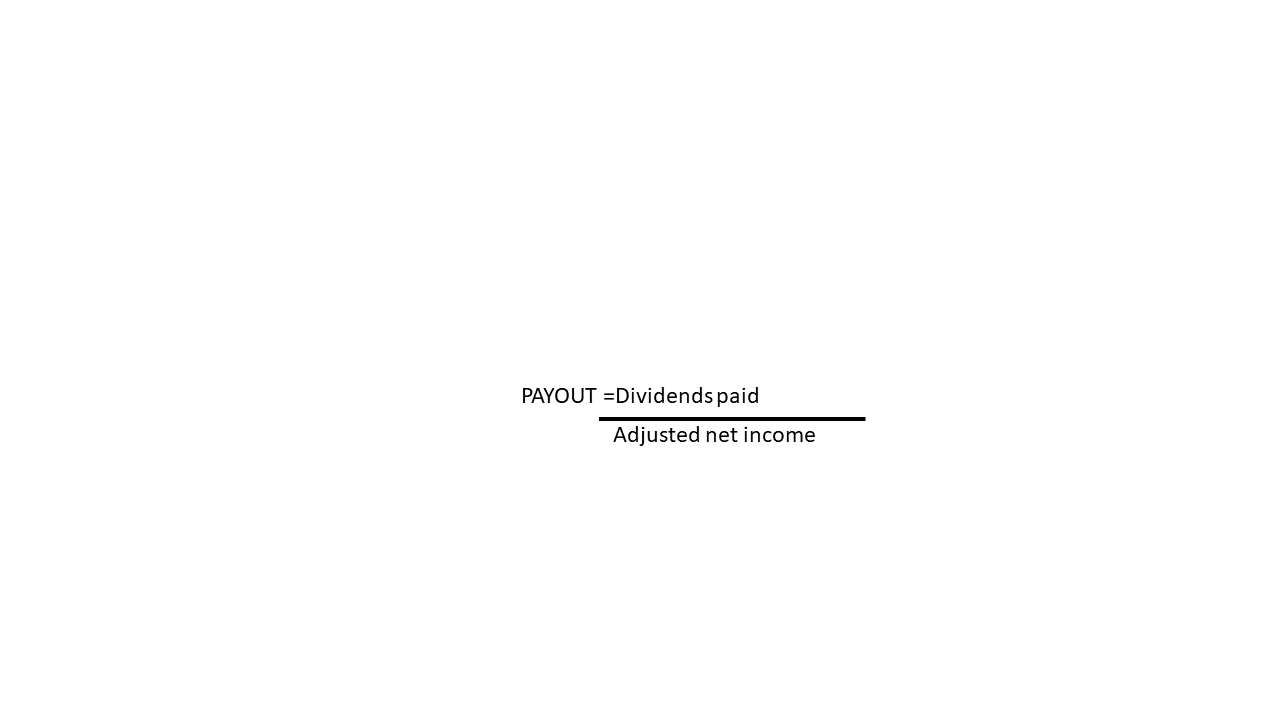

The probability of distributing or retaining earnings (P_DIV) is measured by the dummy variable that takes the value 1 to indicate companies that distributed dividends and the value 0 otherwise. The variable PAYOUT represents the level of earnings distribution across the company in each period of the analysis. Its calculation is shown by Eqn (1).

Eqn (1)

Eqn (1)The investigation of the probability of the firm to distribute/retain earnings considering the female participation was tested by Eqn (2), as follows:

P_DIVit=β0+β1 BDit+β2 EBit+β3 CEOit+β4 BD_EBit+β5 YEARit+β6 LEVit+ β7 GROWTHit+β8 SIZEit+ε

The verification of the marginal impact of the female participation on the level of dividends was carried out through the third Eqn (3), as follows:

PAYOUTit=β0+β1 BDit+β2 EBit+β3 CEOit+β4 BD_EBit+β5 YEARit+β6 LEVit+ β7 GROWTHit+β8 SIZEit+ε

where, P_DIVit: probability of earnings distribution by the company (i) over the period (t); it takes the value 1 when there is a distribution and 0 otherwise; PAYOUTit: amount of declared dividends by the company (i) over the period (t), estimated by Eqn (1); BDit: proportion in percent of women in the board of directors of the company (i) over the period (t); EBit: proportion in percent of women in the executive board of the company (i) over the period (t); CEOit: binary variable on the CEO of the company (i) over the period (t); it takes the value 1 if the gender is female and 0 otherwise; BD_EBit: binary variable of multiple female presence (board of directors or executive board) in the company (i) over the period (t); it takes the value 1 for multiple presence and 0 otherwise; YEARit: binary variable that indicates the performance of the company (i) over the period (t) LEVit: leverage of the company (i) over the period (t); GROWTHit: growth opportunity of the company (i) over the period (t); SIZEit: size of the company (i) over the period (t); ε: error term of the econometric model.

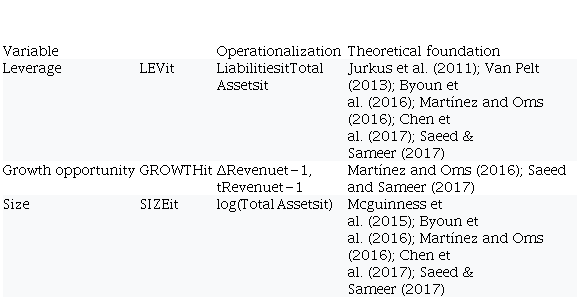

The selection of control variables (LEV, GROWTH and SIZE) was accomplished in order to list exclusively economic and financial attributes and characteristics since they already provide an explanatory power to guide or affect the dividend policy according to the literature review already exposed in Section 2.2, whose estimation was accomplished according to Table I.

Control variables

Source(s): Authors (2019)

We bring forward that choosing such drivers is related to the acquisition of the effects intended by the explanatory attributes listed exclusively regarding the economic and financial relationship already proved as influencers of the dividend policy. In the same line of isolating the effect to be captured, we applied a temporal dummy variable to identify the fixed effects related to each firm, which is the purpose of the study.

3.3 Econometric treatment

The models were regressed considering the individualized effect of female participation; the complete model encompasses the inclusion of the set of variables named according to such participation. In the models, the observation regards the behavior of each firm.

Model (2), which is related to the propension to earnings distribution, was estimated by logistic regression (LOGIT) because, according to Fávero, Belfiore, Silva & Chan (2009), such statistical model investigates the relationship among phenomena whose dependent variable is categorical and binary, which represents the probability of the occurrence of the phenomenon studied according to the explanatory variables. This way, it is possible to identify if the participation of women in management influences the distribution or retention of earnings.

Model (3) was estimated through a regression model with limited dependent variable (TOBIT), defined by Gujarati & Porter (2011). According to Wooldridge (2010), the PAYOUT variable is the limited dependent variable because its interests are limited to the positive values that exhibit an effective declaration of dividends considering, nevertheless, the total sample. The variable, indeed, is approximately distributed in a continuous way across positive values, taking the value 0 to non-relevant part of the population.

The use of such econometric treatment established through the use of the censored variable occurs because there are no negative values for the dependent variable PAYOUT. The censoring occurs after identifying that the dependent variable used in the research only takes values above or equal to zero (Gujarati & Porter, 2011).

Regarding the variable PAYOUT in terms of outliers, the treatment used was the one proposed by Tukey (1977), which implies the construction of boxplots in order to identify values located at a distance 50 percent superior to the interquartile range (i.e. the difference between the first and third quartiles). Based on such criterion, we identified 21 outliers, which correspond to 1.93 percent of the final sample; these outliers were transformed according to the winsorization technique.

The multicollinearity was examined through the calculation of the variance inflation factor (VIF), which measures the correlation among independent variables. The VIF indicated an absence of multicollinearity among such variables, being in accordance with the basic requirements to the LOGIT and TOBIT regression analysis. Moreover, the models presented a quality of model adjustment (pseudo R2) superior to 18 percent and reaching 31 percent with a 1 percent level of significance – such outcomes meet the econometric requirements associated with the method of estimation applied.

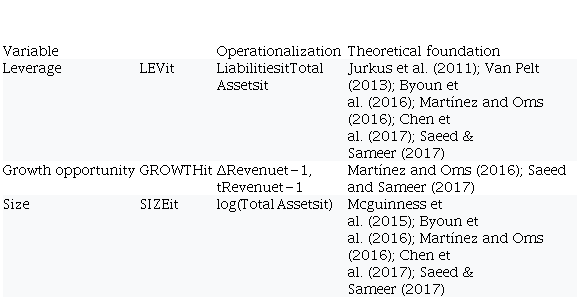

The greater expressiveness of female participation in boards of directors in comparison to the participation in EB can be observed in Panel 2 of Table II; it is possible to emphasize that, in both cases, the mode of such participation is restricted to only one or two female members only in 40 percent and in 32 percent of the companies, respectively, regarding the board of directors and executive board; a presence of 4/5 or more women is observed in only 5 percent of the BD and in six EB.

Female participation in management

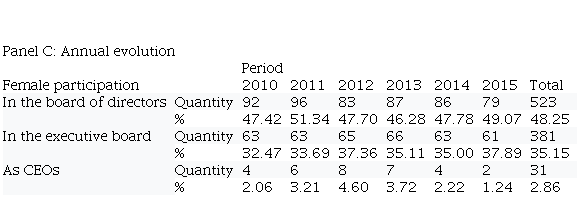

By analyzing the information exposed in Panel B, it is possible to notice that the majority female position occurred only in 17 observations (approximately 1.5 percent) of the BD and in six observations (0.5 percent) of the EB. By analyzing the members of the EB, it is possible to perceive an oscillation regarding female CEOs; there was a variation of two to eight companies with female CEOs, according to the information disposed in Panel C.

Among the firms in which women occupy job positions in collegiate bodies, it is possible to determine a concentration of companies whose bodies are composed by up to 20 percent of female members, which corresponds to 34 percent of the observations of the total sample in the case of the BD and to 19 percent in the case of EB, according to Panel B. We emphasize, therefore, the low female participation in corporate collegiate bodies in the Brazilian business environment.

It is worth mentioning that the low proportion of female presence could be more prominent if second generation family businesses had not been considered, since these companies, according to the succession proceedings, tend to place women in the BD as legal heirs. Such factor occurs to maintain the composition of deliberative bodies with the family as majority shareholders.

In Panel C, it is possible to observe that the position of women in the bodies under discussion did not alter substantially over the period analyzed. The participation in boards of directors and EB remained relatively stable, with the participation of approximately 48 percent and 35 percent, respectively.

In the last year of the sample, it is possible to observe a smaller number of companies that had women occupying BD, EB and CEO positions. However, one can verify that such number is proportionally superior when compared to the first year of the analysis.

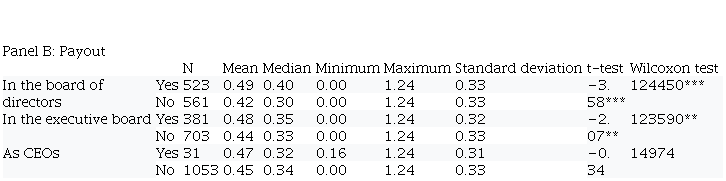

In Table III, the dividend policy is evidenced regarding the companies that have women occupying BD, EB and CEO positions. Panel A indicates that from the 523 observations with female presence in the BD, there was earnings distribution in 90 percent (472) of them; when analyzing the 561 observations that had no women occupying such positions, the earnings distribution was identified in 85 percent (478) of the observations. Such behavior is also verified in 381 observations, in which women occupied executive board positions; in these cases, 92 percent of them (350) declared dividends; in the 703 observations with no female participation in the executive board, in 85 percent (600) of them there was earnings distribution. In the cases in which women occupy CEO positions, all companies distributed dividends over the period; in the case of male CEOs, the earnings distribution was observed in 87 percent of the cases

Dividend policy and female participation

Note(s) Significance level of 1% (***), 5% (**) and 10% (*)

We highlight that the superior proportion of companies that declare dividends can occur due to the regulation regarding minimum mandatory dividends. We observe that the presence of women in strategic positions is associated with the distribution or retention of earnings – considering a univariate analysis with statistical significance – which indicates that such condition differentiates the behavior of such bodies regarding this dividend decision.

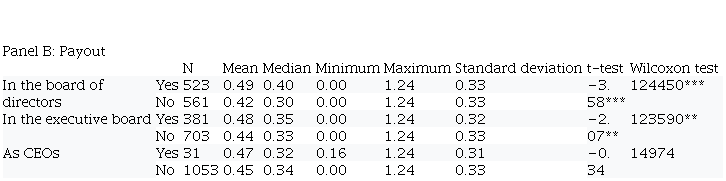

Data displayed in Panel B indicate that the payout distribution is presented in an asymmetrical way with only a few companies practicing high levels of dividend payments; most of them adopt policies of low dividend payout ratio. Considering that such behavior occurs regardless of female participation, there are exogenous factors that lead a small group of companies to the adoption of higher dividend payout ratio.

Panel B also indicates that the payout level is significantly higher when there is a woman in the composition of collegiate directive bodies of companies. On the other hand, there is no such differentiation when comparing companies in which women occupy a CEO position; considering that such case occurs in only 3 percent of the observations, they do not seem to interfere with the evidences that payout decisions of a firm are differentiated by the female presence in managerial bodies. We will proceed with the analysis to examine the influence of the female gender in multivariate tests indicating the impact of economic variables, which are the primary sources of such behavior.

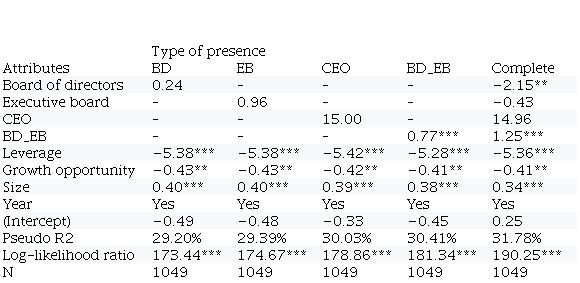

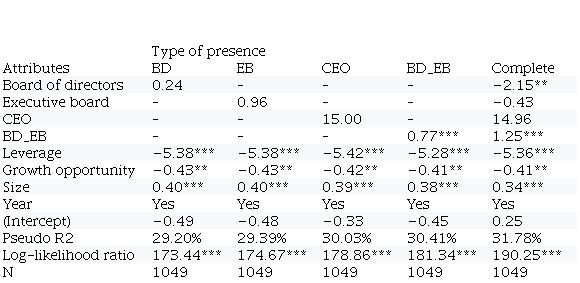

It is possible to verify, based on the information disposed by Table IV, that the probability of earnings distribution is not affected singly by the proportion of women in the BD, in the EB or by women occupying CEO positions. However, the coexistence of more than one woman in whichever deliberative bodies (BD_EB) contributes, with a 1 percent level of significance to the propensity to declare dividends, which contradicts the earnings retention act. It is also possible to notice that a stronger female presence in the BD reveals a contrary effect: it reduces, at a 5 percent level of significance, the propensity to declare dividends, which highlights the strength of the operational level to make such decisions.

Female participation and probability to distribute earnings

Note(s): (1) Significance level of 1% (***), 5% (**) and 10% (*); (2) the number of observations was reduced from 1,084 to 1,049 in these tests due to the non-observance of control variables' data in 35 companies

When all variables of interest are processed in the complete model (last formulation), it is possible to identify that the probability of earnings distribution is positively affected by the female presence in deliberative bodies, which is moderated by the female proportion in the BD considering the negative coefficient estimated.

It is worth mentioning that, from an economic and financial perspective, the variables that guide the dividend policy behaved as expected (dividend theory); larger companies tending to distribute earnings (1 percent level of significance); leverage and growth opportunity influencing the earnings retention (1 percent and 5 percent levels of significance, respectively) due to the need for additional cash flows or investment intention. On the other hand, the analysis corroborates the inference suggested by univariate association tests between earnings distribution and female presence in directive bodies (Table III, Panel A).

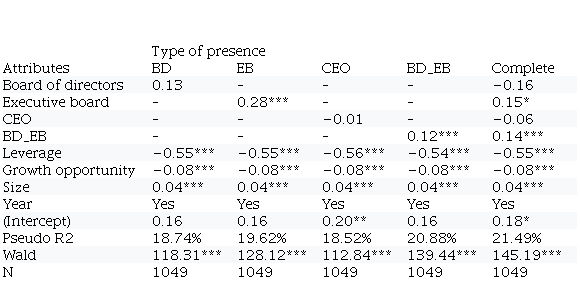

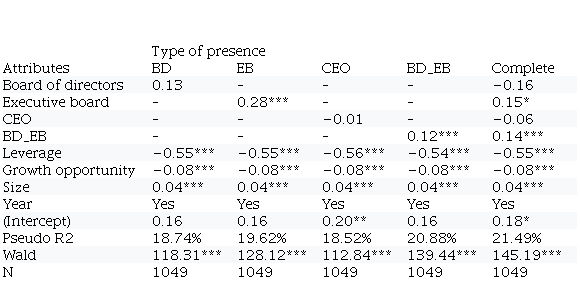

We determine, based on the information exposed in Table V, that the female presence in the BD or as CEOs does not affect singly the payout level in the companies investigated herein; it is, therefore, also possible to emphasize that the increase in the proportion of women in the EB (1 percent level of significance) influences the payout level of firms; one can notice the moderating power of the female presence in the BD considering that when the situation is common in the EB and in the BD (BD_EB), the level of dividend payment is affected with lower intensity because the coefficient given by the model is reduced and the variables are considered jointly (complete model), with the same level of significance. When comparing the isolated to the female presence in both bodies effect, the payout level is affected by half of the proportion.

Female participation and dividend payout ratio

Note(s) (1) Significance level of 1% (***), 5% (**) and 10% (*); (2) the number of observations was reduced from 1,084 to 1,049 in these tests due to the non-observance of control variables' data in 35 companies

The outcomes verified regarding economic variables, whose levels of significance were inferior to 1 percent, are consistent with the literature inferences mentioned herein and behave as expected according to economic and financial theories on the matter.

On the other part, the analysis also corroborates the inference suggested by univariate tests that associate the level of payout with female presence in directive bodies (Table III, Panel B), which refines the type of participation that effectively affects marginally the relationship studied.

The results obtained from the test on the influence of female participation regarding the propensity to distribute earnings are not in accordance with Martínez & Oms (2016), at least in the Spanish scenario, through which the gender diversity in upper management bodies leads companies to pay dividends. On the other hand, the outcomes indicate that the influence of the female presence in both upper management bodies on the propensity to distribute earnings are in accordance with Byoun et al. (2016), who identified a positive relationship between the presence of at least one woman in directive bodies and the propensity to distribute earnings in the North American environment.

Regarding the outcomes on the payment level of dividends and its relationship with the proportion of women in the executive board, there is a convergence with the findings identified by Martínez and Oms (2016) and Chen et al. (2017). While Martínez & Oms (2016) identified a positive impact of gender diversity on the dividend policy of companies, Chen et al. (2017) reached similar results in companies with weak governance in the North American market.

The evidences that refer to the isolated effect of the proportion of the female gender on the BD or their presence as CEOs regarding the level of payment of dividends corroborate the findings of Van Pelt (2013) and Mcguinness et al. (2015). Van Pelt (2013) shows some similar results, not identifying the influence of the gender on the dividend levels in the North American market. The same way, Mcguinness et al. (2015), when conducting an analysis in the Chinese environment, observed that the dividend policy is not related to the gender of the members of the governance of the companies analyzed.

Considering the presence of more than one woman in whichever directive body analyzed herein, the outcomes converge with Byoun et al. (2016), who identified a positive relationship between the distribution level of dividends and the presence of at least one woman in directive bodies of firms in the North American scenario.

By contrast, the negative relationship conducted by gender diversity on payout was verified by Jurkus et al. (2011) and Saeed and Sameer (2017), who go against the findings of this study considering that they did not identify a significant negative relationship between the variables that measure gender diversity and payout. The authors analyzed the North American market and companies from India, China and Russia and concluded that gender diversity – measured by the proportion of women in directive bodies – has a negative impact on the dividend policy of the companies.

Our research investigated the female participation in executive and deliberative bodies of Brazilian firms in terms of its influence on the dividend policy. Such research goal arises from concepts and evidences that suggest that the heterogeneity of governance and management groups may imply diverse entrepreneurial decisions, especially in the institutional sense of mitigating conflicts among interest groups.

The earnings distribution of the firm lies in the center of possible governance conflicts; moreover, it is possible to state that the independence of deliberative bodies due to a greater female participation could improve control mechanisms and the reduction of conflicts between managers and investors.

The research hypothesis, which was based on international evidences and on the growing conceptual background on institutional, behavioral and social motivation in economic and financial decision of firms, was not rejected. The hypothesis stated that a stronger female participation in executive and deliberative bodies could increase the probability of earnings distribution and the level of payout. The female participation in management bodies is, therefore, emphasized; it is possible to identify a moderating factor in governance bodies due to a stronger female presence.

Despite the low percent of female participation in the firms presented in our sample, the research findings, which were based on a strong econometric support, address public-traded companies, which could hinder the characterization of behavioral differences because of this sort of heterogeneity. Therefore, at the margin, the earnings distribution (retention) and the payout level show a diverse behavior among the groups with female participation in both governance and management, considering that the basic economic explanation was kept for such decisions (leverage, investment opportunities and size of the firm).

The outcomes brought by the research findings indicate that the plural female presence is important to differentiate decisions among collegiate bodies in Brazilian firms in terms of dividend policy; women in the executive board contribute marginally to the increase of earnings distribution and to the increase of the payout level. On the other hand, women in the BD are also important for such decisions, which indicate a more moderating impact on the rates and levels of dividends; no conclusion could be drawn on the influence of women in such policies when the CEO position is occupied by a woman.

Such context is in accordance with Van Pelt (2013), who claims that research studies that address economic effects of gender diversity in management are not conclusive; the author emphasizes that divergent outcomes were noted in research studies conducted in more integrated and developed economic environments than the scenario of our research. The diffuse explanatory determination of heterogeneity implies an association of such attribute with the difference of social, economic and institutional aspects of the Brazilian environment, in comparison to countries that are more developed in such issues. This affirmation stems from previous research findings conducted in other environments – in Brazil, such investigation seems to be unprecedented – in which the existence of the female presence can be found in more integrated environments; however, the findings are also divergent among themselves, despite the econometric robustness.

If it is possible to insinuate that the greater presence – in quantity – of women in directive bodies can affect the economic decision of earnings distribution in Brazilian companies, then such affirmation can indicate that the female insertion in directive bodies can work as a control mechanism within companies, considering that once heterogeneity in groups is promoted, such fact can alter the content of the decisions made.

The approach used in the research does not clarify issues related to motivations. The analysis of such issues is relevant to strengthen and to deepen the analysis of theme in the Brazilian academic environment and, for such reasons, we suggest the utilization of a different approach from the one applied herein. The phenomenological approach, for instance, can examine the phenomenon in depth while trying to get the right answers for such issues.

The unfolding of the investigation on the theme can occur through the inclusion of tests of correlated attributes, such as variables with different measurements of female participation, including variables that represent the permanence time of women in management positions; non-economic control variables; participation of diverse racial or ethnic origins; governance-related attributes, i.e. legal form of the company (family, state-owned company), ownership structure and characteristics of investors; other management attributes: internal control mechanisms, supervisory board and committees related to governance and management.

Control variables

Source(s): Authors (2019)

Female participation in management

Dividend policy and female participation

Note(s) Significance level of 1% (***), 5% (**) and 10% (*)

Female participation and probability to distribute earnings

Note(s): (1) Significance level of 1% (***), 5% (**) and 10% (*); (2) the number of observations was reduced from 1,084 to 1,049 in these tests due to the non-observance of control variables' data in 35 companies

Female participation and dividend payout ratio

Note(s) (1) Significance level of 1% (***), 5% (**) and 10% (*); (2) the number of observations was reduced from 1,084 to 1,049 in these tests due to the non-observance of control variables' data in 35 companies